FA Reps vs Insurance Agents Singapore: LIA Trends & Financial Consultant Career Paths

Singapore’s life insurance industry is undergoing a seismic shift. Financial Adviser (FA) representatives are rising, while tied insurance agents are seeing a decline. The latest LIA data confirms it, and if you’re a mid-career professional or tied insurance agent, this matters.

We breakdown key trends from the LIA's Q1 2025 industry results, explain the FA vs tied rep models, and show why more are switching to future-ready platforms to serve clients' needs better.

What’s the Difference Between a Tied Insurance Agent and FA Representative in Singapore?

If you’re comparing tied insurance agent vs FA representative roles in Singapore, the difference is more than just job titles. There are differences in platform flexibility, product access, and career growth.

A tied insurance agent is contracted to one insurer. They can only recommend and sell products from that single company, even when better solutions may exist elsewhere. Think insurance agents from Prudential, Great Eastern, AIA, etc.

A FA rep, on the other hand, works under a licensed Financial Advisory firm. This gives them access to products from multiple insurers, investments and more, offering clients better-fit solutions and giving advisers more control over how they build their business.

In short, when comparing financial adviser vs insurance agent models in Singapore, the FA representative model stands out. It offers greater flexibility, broader product access, and stronger long-term potential for advisers serious about delivering client-centric solutions and build a sustainable, future-ready career.

FA Reps Outperform Tied Agents: Key Trends from LIA Singapore

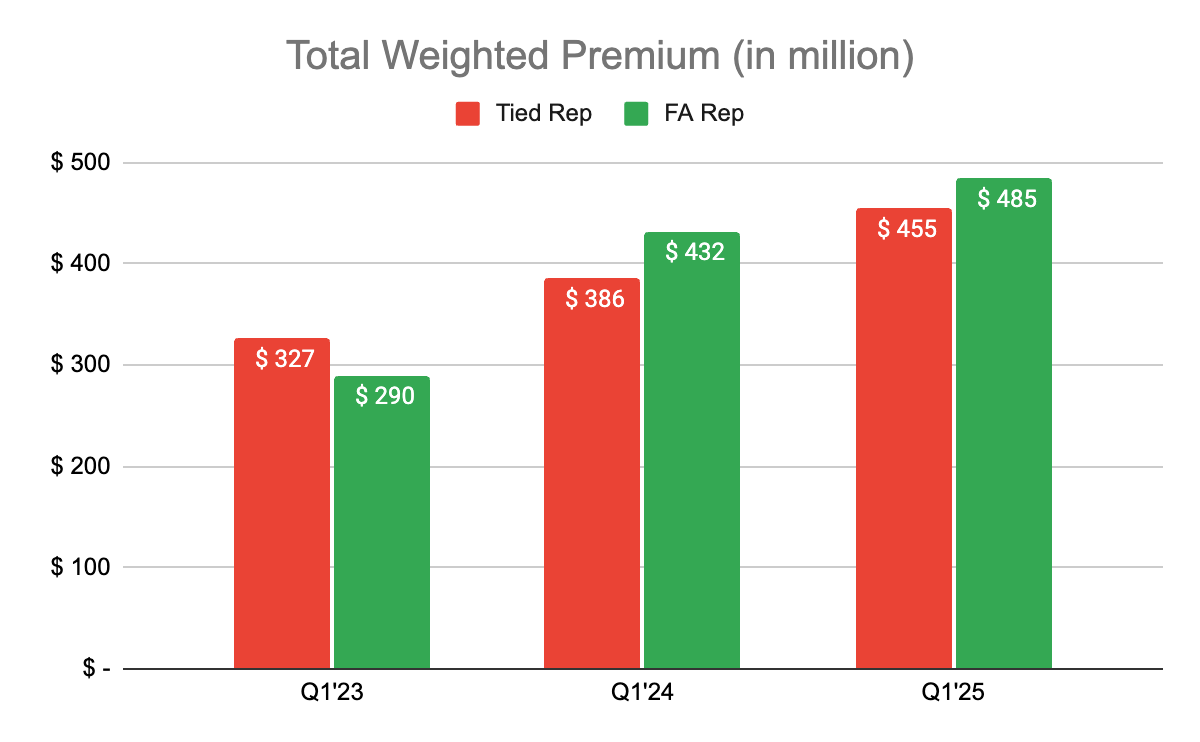

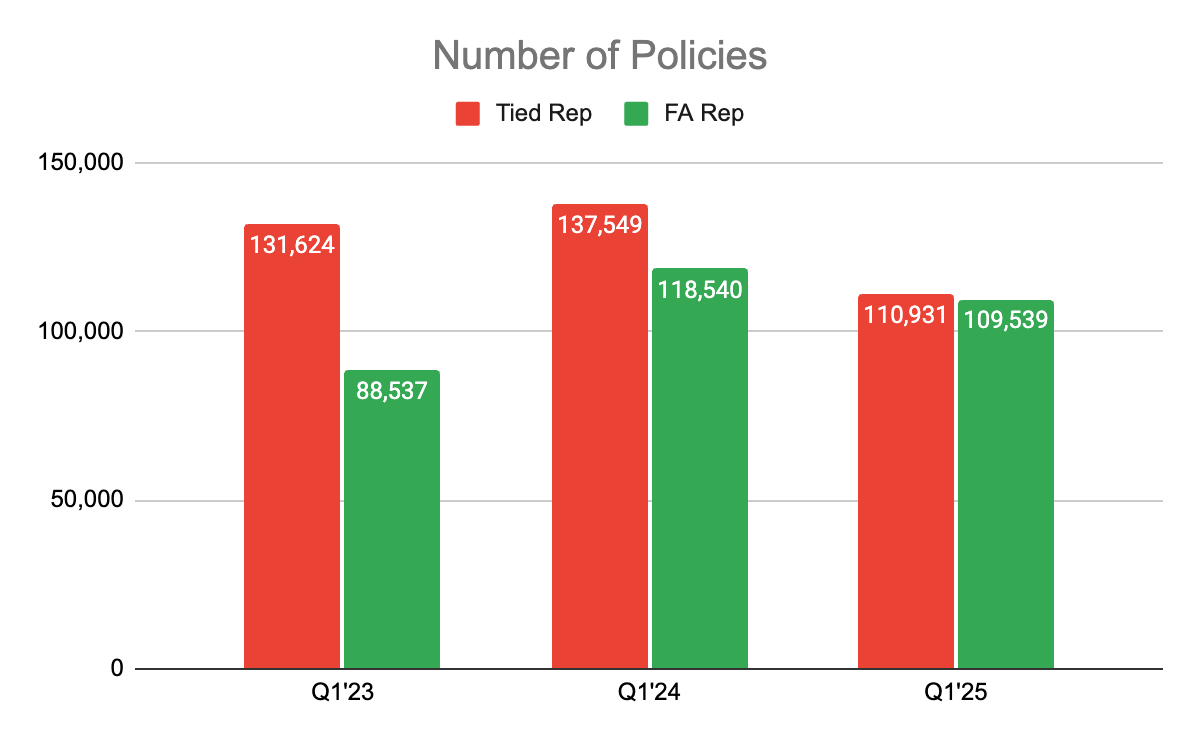

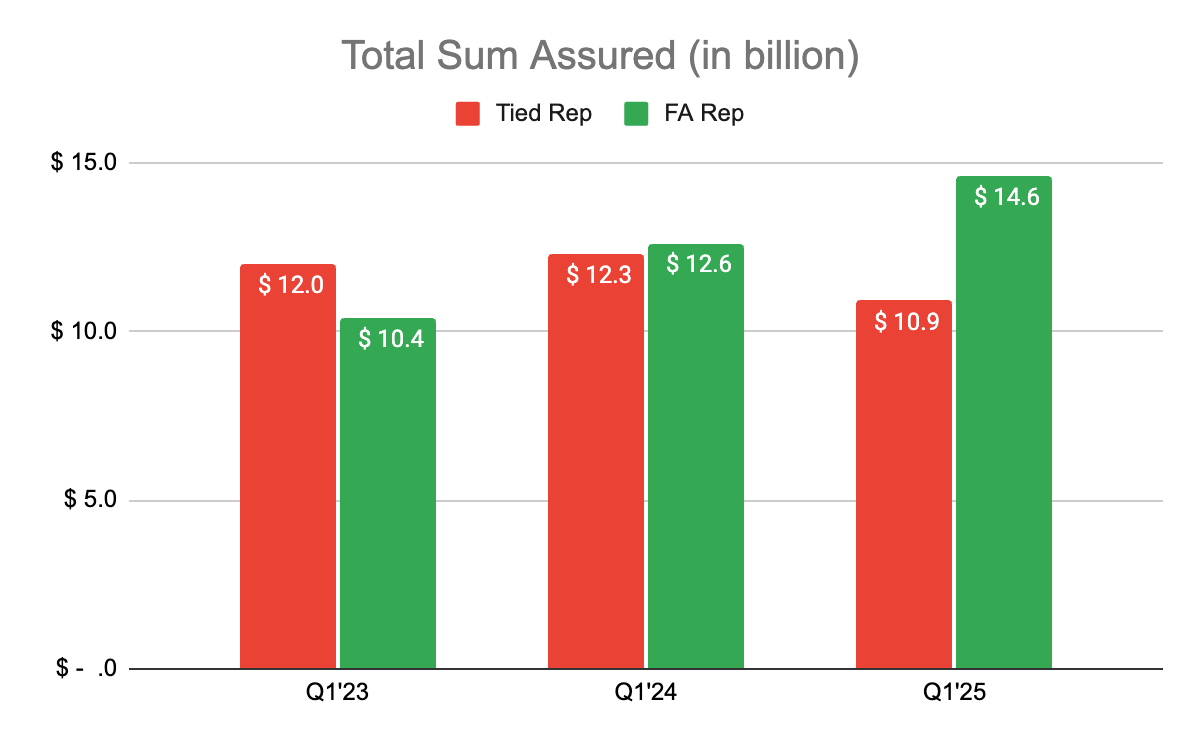

According to the LIA Q1 2025 results, FA representatives are now outperforming tied agents across all major indicators for New Business (Individual Life and Health).

In addition, the number of tied representatives has declined from over 14,000 in 2023 to just 12,385. While there are no official figures for FA rep headcount, industry estimates as of Nov 2024 put that number at over 5,000. The results you see above are 12,385 agents versus 5,000+ FA Reps.

This latest data reinforces what many in the industry already sense - FA reps are not just growing in numbers, they’re also more productive. FA reps are securing higher premiums and larger sums assured than tied agents. If you are evaluating where the real growth and earning potential lie, this shift is hard to ignore.

Why Are Insurance Companies Starting Their Own FA Firms in Singapore?

In recent years, major insurers in Singapore such as Prudential, AIA, Singlife, and Manulife have launched their own FA firms (eg. AIA Financial Advisers, Manulife Financial Advisers, or Great Eastern Financial Advisers). This reflects a clear industry direction. Even traditional insurers are recognising the limitations of the tied agent model.

By setting up FA arms, these insurers aim to retain experienced agents who want more flexibility, while expanding their reach in a changing market. Although these insurer-backed FA reps may have slightly more product variety than tied agents, their offerings and incentives tend to focus heavily on in-house products.

This trend highlights two key points:

- The tied agent model is sunsetting, and insurers know it.

- The industry is moving towards platforms that provide greater product flexibility and advisory depth.

While insurer-backed FAs offer more autonomy than tied roles, they still come with restricted distribution compared to independently-owned financial advisory (IFA) firms like finexis advisory. Choosing the right platform can significantly impact your ability to serve clients holistically, and grow your practice with fewer limitations.

IFA vs Insurer-Backed FA: Which Offers More Opportunity?

As you explore your next step, it’s important to understand how each type of platform works and how it affects your ability to grow your practice.

|

Feature |

Tied Agent |

Insurer-Backed FA |

IFA |

|---|---|---|---|

|

Product Access |

One insurer only |

Mostly parent company, some external |

Multiple partners, full open shelf |

|

Sales Targets |

Set by agency |

Often aligned with parent insurer |

Aligned with your business goals |

|

Client Fit |

Limited |

Improved, but still biased |

Full customisation possible |

|

Growth Potential |

Capped |

Some flexibility |

Scalable, adviser-driven |

If you want to build a client-first, future-ready practice, the IFA platform gives you the tools and freedom to do it right. Most importantly, if you are a client, will you choose to work with a tied agent, insurer-back FA, or IFA?

Career Switch to Financial Consultant: Is Now the Right Time?

LIA Singapore data signals a robust industry ripe for growth. This is not a fleeting trend. It represents a strategic evolution in financial advice, moving towards comprehensive, client-centric solutions. You understand FA representatives significantly outperform tied agents. Now, consider the crucial question: Is this your moment to make the switch to join a FA?

For Mid-Career Professionals in Singapore:

A financial advisory career offers a uniquely rewarding path. You can directly leverage your existing professional skills - communication, problem-solving, strategic thinking, client management - in an impactful new way. Many of our financial consultants in Orion Wealth Partners transitioned without prior industry experience. They thrive with the right training, mentorship, and a supportive platform. Becoming a financial advisor mid-career is a common and viable path for those seeking greater purpose and work autonomy.

For Insurance Agents in Singapore:

You ask, "Is it worth switching from tied agent to FA?" The industry's answer is a resounding "YES". Moving to a comprehensive FA platform allows you to offer a broader suite of solutions. finexis' extensive offering means our Financial Advisers can serve clients holistically, deepen relationships, and significantly grow their practice. You can operate without the limitations of a tied agency or insurer-backed model.

Your Next Step: Explore FA Opportunities in Singapore

The future of financial advisory is unbiased and client-focused. Whether you are an ambitious insurance agent or a mid-career professional, your career transition to a FA Representative in Singapore is a strategic career move!

Take your next step to a better, bolder future. Drop me a message on Linkedin for a confidential, non-obligatory session to explore how our platform empowers your growth.