Orion Conservative Investment Portfolios

In 2022, as businesses were recovering from the challenges of Covid-19, one of our consultants met a business owner with a substantial amount of unused cash from an inheritance. The owner had heard that the S&P 500 ETF was a reliable option for investment and was inclined to believe it was among the safest bets.

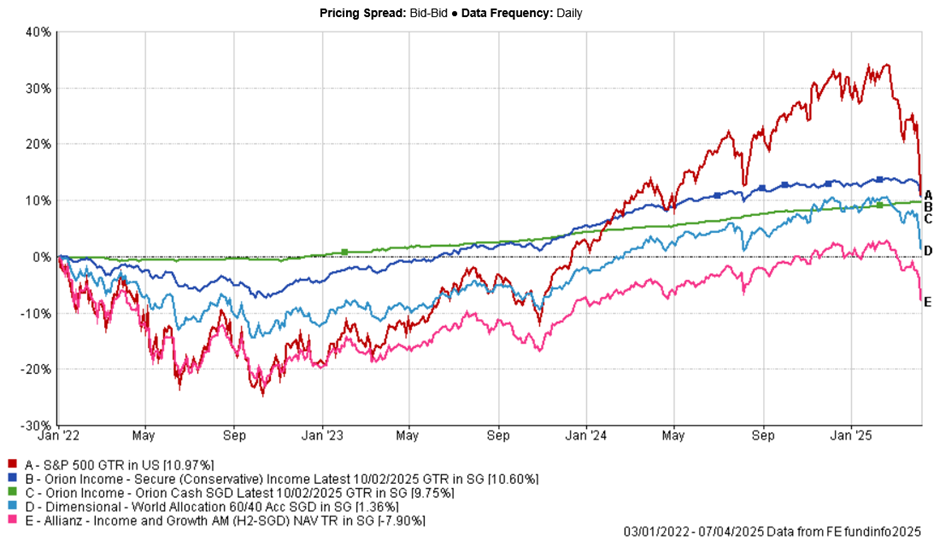

We explained that while the S&P 500 is often viewed as a strong benchmark for market performance, it remains a volatile investment, and the S&P500 is an investment that inherently carry much risks. Despite this discussion, the business owner proceeded with the investment. It ultimately took two years for the investment to just turn positive, highlighting the challenges of relying solely on broad market indices for cash optimization.

Income Portfolios for Stability, Yield and Liquidity

This experience prompted us to explore solutions that could better serve individuals and businesses seeking more conservative, reliable ways to invest their cash. These solutions are designed with three primary goals in mind: to preserve capital, provide consistent annual returns, and maintain the liquidity required for easy access to funds.

One such offering is the Orion Secure Income Portfolio, which is one of the lowest-volatility portfolios in Singapore. It allows investors to participate in global markets while substantially mitigating risks. For those prioritizing capital safety, the Orion Cash Portfolio provides an ultra conservative option. It delivers returns that exceed the highest fixed deposit rates in local currency, offering both security and flexibility without any maximum cash limits. A business could invest $10M of its unused capital and earn a target return of 4% p.a. just like retail investors.

These Conservative alternatives help align investments with the risk tolerance of individuals or organizations, and practical liquidity needs. Thoughtfully designed portfolios can help achieve this balance while avoiding unnecessary volatility.

Bearing in mind that past performance is not indicative of future performance, historical performance data highlights the benefits of these portfolios. For instance, a $1M investment in the Orion Secure Income Portfolio in January 2022 would have not only recovered faster but also ride through the various market sell-offs in 2022, 2023, 2024 and 2025, and generated a return of over $100,000 to date.

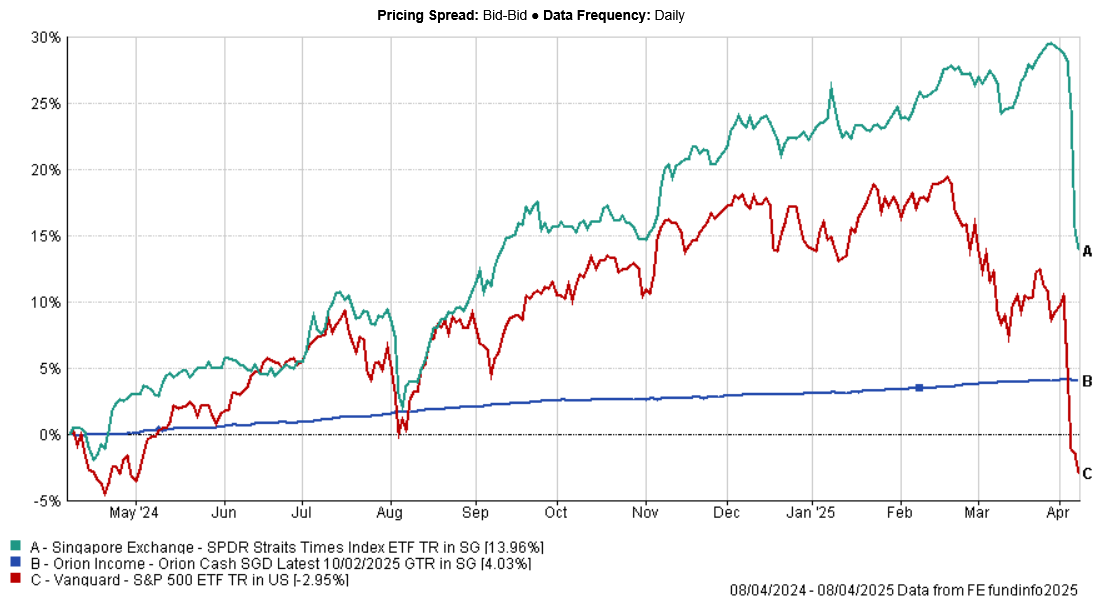

This 1-year performance chart compares the Orion Cash Portfolio (the blue line) against the S&P 500 and the Straits Times Index. For the ultra-conservative, it’s a standout choice compared to fixed deposits and Singapore Savings Bonds.

For those prioritizing stability, the ultra-conservative Orion Cash Portfolio stands out with a near flawless record—no losses in any year over the past two decades. This track record spans numerous crises, from the great financial crisis and global conflicts to pandemics to wars, showcasing its ability to weather challenging times. A $1M investment in January 2022 would have achieved an absolute return of about $95,000 today — over 4% p.a.

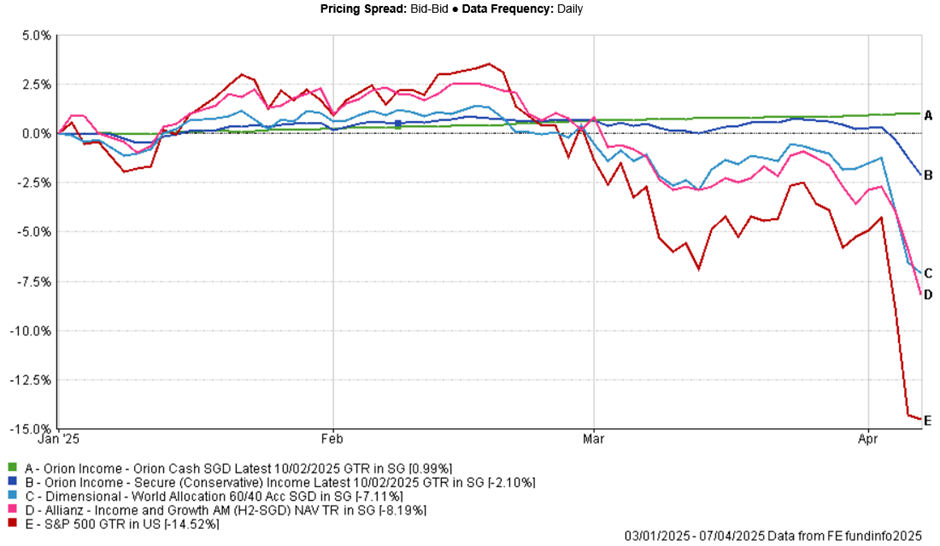

Even in the context of ongoing fears and uncertainties, such as the Trump tariff wars, these portfolios are designed to provide better stability and resilience for investors.

For individuals seeking a highly conservative approach, the Orion Cash Portfolio offers an added advantage — daily interest accumulation, ensuring stable and predictable returns minimizing undue risk.

These portfolio alternatives are not only useful for businesses. They are also available to individuals and couples, providing thoughtful and sustainable investment strategies that align with diverse needs and risk appetites.