Orion Income Portfolios – Market Update (Dec 2025)

Last week, the Dow Jones Industrial Index closed at a fresh record of 48,704.01

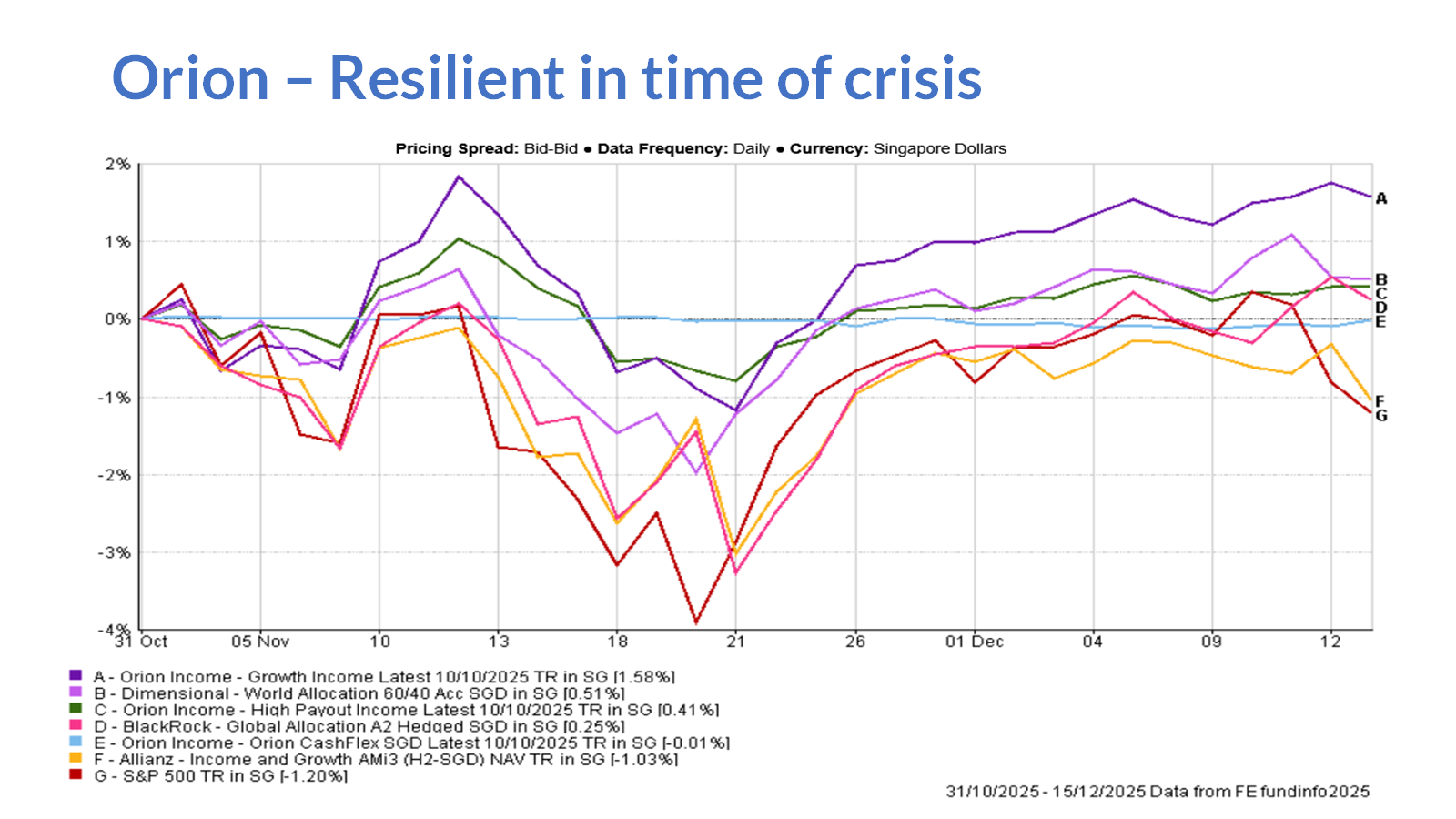

📈 Investors rotated to cyclicals and value names, away from Tech. This has led the DOW to fresh highs as the U.S. Federal Reserve cut interest rates by 25 bps on December 10, 2025, lowering the federal funds target range to 3.5% - 3.75%. This has benefited the Orion Growth Portfolio as it continues to deliver near record highs demonstrating resilience against a backdrop of uncertainty.

📝 The past two months have been more volatile, with markets still heavily influenced by U.S. administration policies. October’s gains were largely eroded by November sell‑offs, particularly in U.S. tech mega-cap equities. This backdrop has heightened uncertainty over the economic outlook.

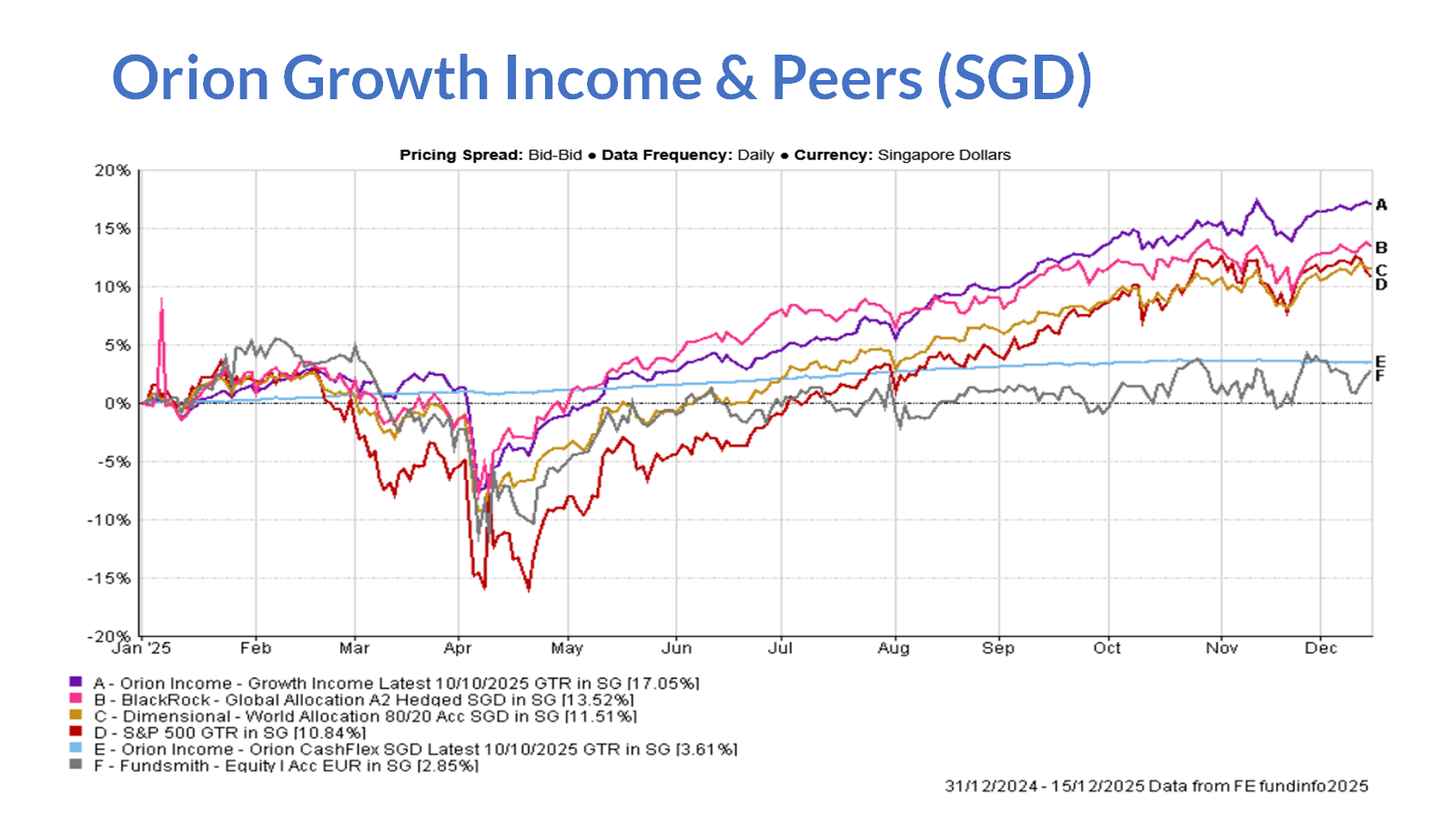

Orion Income Portfolio YTD Performance

The Orion Growth Income Portfolio, with approx. 80% exposure to equities, continues to lead other funds and portfolios including those from BlackRock, Dimensional and Fundsmith. Year-to-date, this strategy has enabled our investors to gain over 17%, outperforming the S&P 500 by more than 6%.

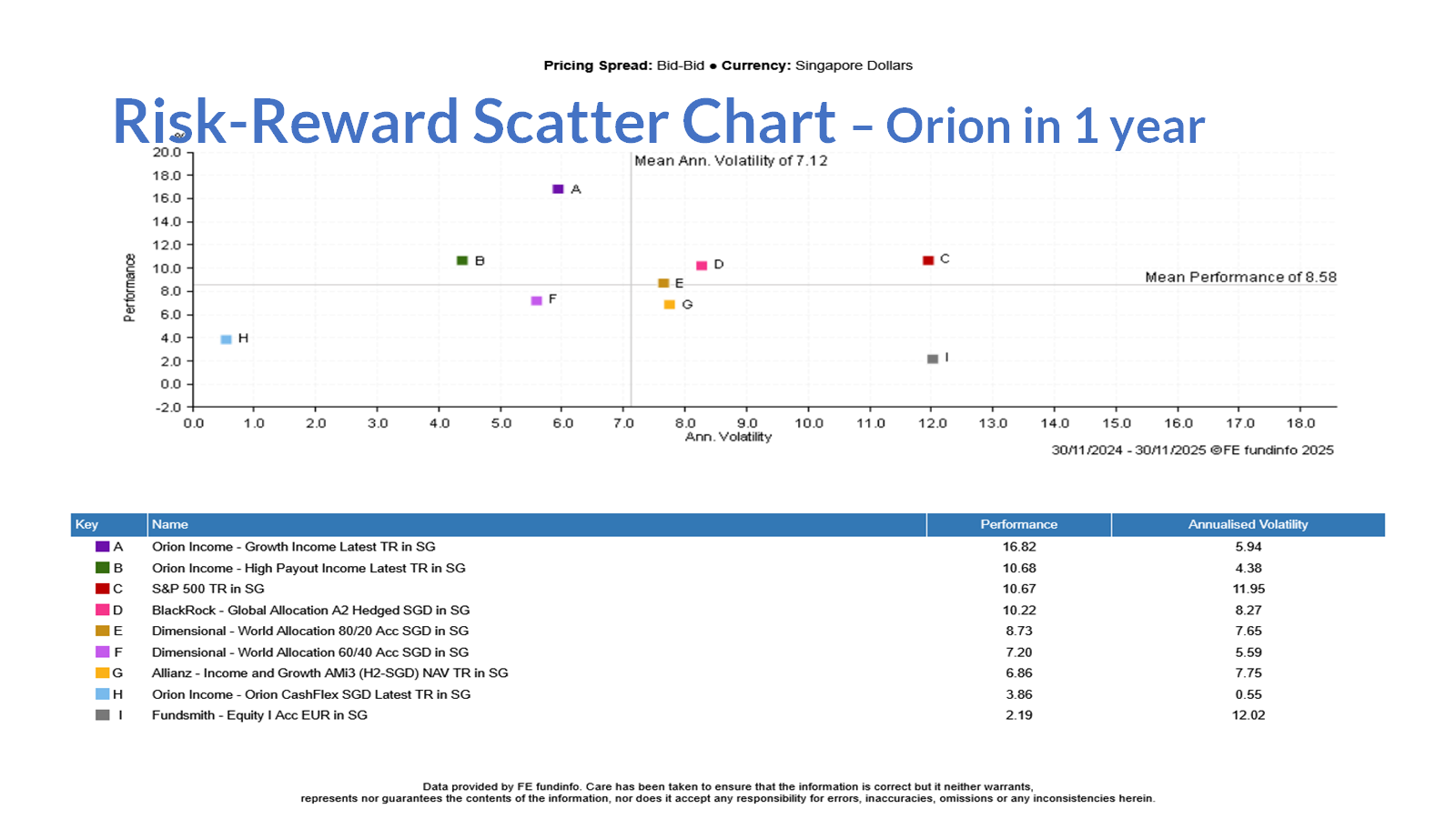

The 1-Year Risk-Reward scatter chart reveals how Orion Income Portfolios were able to perform well above their peers, while maintaining much lower volatility.

Market Overview

Technology Sector Weakness

Many technology stocks slipped amid ongoing concerns of an “AI bubble.” Both the S&P 500 and Nasdaq fell around ‑4% at some point, though they have since recovered in recent weeks.

Macro Supportive Factors

Markets remain supported by resilient economic data, contained inflation, and the December Federal Reserve rate cut. These factors continue to underpin investor sentiment despite heightened volatility.

Broadening Market Leadership

Importantly, performance has broadened beyond the largest technology names. In November, the average S&P 500 stock outperformed the “Magnificent 7” (+1.9% vs. ‑1.1%), signaling healthier market breadth and reduced reliance on mega‑cap tech leadership.

Fund Performance & Outlook

Despite corrections across many funds, our Orion Income strategies have held on to gains, reflecting cautious optimism and resilience. With 2025 still on track to deliver solid returns, maintaining strong diversification and protective portfolio strategies remains essential. For investors, resilience is best achieved through disciplined diversification.

The Orion Income Portfolios demonstrate how thoughtful allocation can capture upside while reducing risk, balancing exposure across companies with strong fundamentals, value opportunities, and income‑focused assets. This breadth of positioning has allowed us to navigate uncertainty while continuing to benefit from opportunities to generate consistent income streams for our clients.

By employing diversification with meaningful participation in growth, our portfolios are well‑equipped to withstand short‑term swings and are positioned for sustainable performance into 2026 and beyond.