Chocolate Finance Saga: A Wake-Up Call for Digital Investors

In the world of financial planning and investment, Singapore is often regarded as a safe haven. Monetary Authority of Singapore (MAS) is widely considered the gold standard to provide the regulatory framework for financial institutions so that investors generally enjoy a high level of protection. However, recent developments involving a licensed digital wealth platform, Chocolate Finance, have sparked concerns and raised important questions:

- Are MAS-licensed firms truly safe?

- What's the role of influencers in its rise and fall?

- What lessons can investors learn from the Chocolate Finance saga?

Let’s take a closer look.

What Happened with Chocolate Finance?

Chocolate Finance is a MAS-licensed digital wealth management platform that was founded last July by the same founder of Singlife, Mr Walter de Oude. Its success was remarkable: in just 7 months, it hit $1 billion Asset under Management! Unfortunately, one month after this meteoric rise, the red flag came. Chocolate Finance suspended its instant withdrawal feature, citing an “unusually high volume” of withdrawal requests.

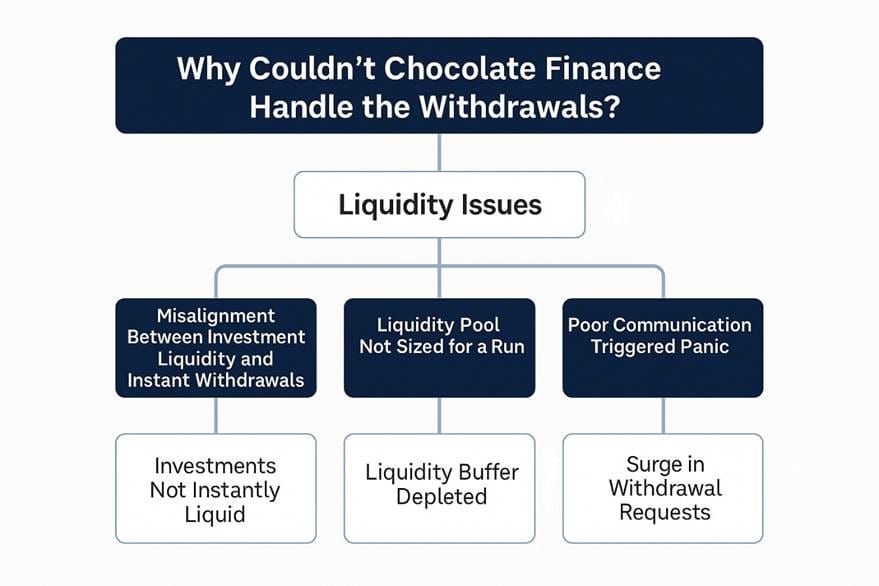

While the firm reassured customers that the move was not due to liquidity issues, the sudden freeze sparked panic and further prompting a rush to exit.

Chocolate Finance primarily invested its clients' funds in a diversified portfolio of short-duration, high-quality fixed-income and money market funds. These investments were designed to offer stable returns with a focus on capital preservation. In their website, some of the funds included in their portfolio are popular funds such as:

- Dimensional Global Short-Term Investment Grade Fixed Income Fund

- UOBAM United SGD Fund

- Fullerton Short Term Interest Rate Fund

- Lion Global Short Duration Bond Fund

- Nikko AM Shenton Short Term Bond Fund

- Dimensional Global Sustainability Short Fixed Income Fund

While these funds are generally sound, they are not instantly liquid as most unit trusts require an average of T+2 (days) trade settlement basis. Although MAS mandates that a fund holds a liquidity buffer, it is not sized for mass withdrawal. This is similar to the 2008 subprime crisis when many banks collapsed because of “bank runs”.

The prominent role of financial influencers

A client asked me last year if she should invest into the 4.5% interest claimed by Chocolate Finance that she saw on a bus advertisement? Without doing any due diligence, I gave her a general caution of my opinion of new, untested digital investment platforms, MAS-licensed or otherwise. From that point, I started to see Chocolate Finance appearing in my social media feed.

Chocolate Finance wasn’t just another digital wealth platform. It rose to prominence rapidly, thanks to slick branding (to disrupt traditional banking), a mobile-first experience targeting Gen Z investors, and an influencer-backed marketing strategy. Endorsements by local personalities, finance bloggers, and lifestyle content creators lent credibility and popularity to the platform.

Influencer-marketing proves to be a double-edged sword for the firm. As quickly as it rose to prominence, it went downhill just as fast. When Chocolate Finance abruptly announced the AXS payment removal and later froze instant withdrawals, those same influencers went silent and deleted their promotional contents, leaving investors to wonder if the contents were legitimate or merely “pay for praise” gimmicks.

That brought up another question that may be in some investors’ and financial planners’ minds:

- Isn’t the activity of financial advice only to be conducted by licensed advisors

- Does MAS regulate the financial “opinions” or “education” by unlicensed financial influencers, bloggers or famous personalities?

- Aren't marketing collaterals cleared by compliance according to strict guidelines to curb misrepresentation or inducement?

This situation raises important considerations for anyone involved in financial planning in Singapore. Is regulatory licensing enough of a safety net? Does regulation extend to the social media and other user-generated contents?

Key Lessons for Investors

In spite of this saga, can we still trust MAS’s regulation? I have no doubt. MAS remains a world-class standard in financial regulation. In the case of Chocolate Finance's withdrawal curbs, regulators stepped in to handle with transparency and speed.

Hence, the important thing is not to abandon these licensed platforms but to approach them with informed caution. MAS licensing is a layer of protection, but not a guarantee against operational or marketing risk.

Here are three ways we can avoid missteps in digital investing:

Don’t confuse popularity with credibility

Don't outsource your financial decisions to financial bloggers or influencers. They may not be qualified professionals to understand the intricacies of complex financial platforms or products. Speak to a competent and experience licensed professionals whenever possible.

Read the Fine Print

Understand the terms related to fund access, withdrawal policies, and liquidity. If you're building a diversified investment portfolio, ensure your assets aren't locked in without a contingency.

Diversify, Diversify, Diversify

Don’t put all your funds in one platform, no matter how secure it seems. Spreading your money across various investment vehicles—from unit trusts to ETFs and real estate—can reduce your exposure to platform-specific issues.

Final Thoughts: Safer Investment Amidst Choices

The prominent role of influencer in the rise and fall of Chocolate Finance points to a new but powerful layer involved in the world of investment, especially among Gen Z investors - consumer psychology, trust dynamics of social media, virality and influencer marketing.

These factors are influencing investors decision more than ever before. This calls for a greater need to pair regulatory trust with personal responsibility.

Whether you are building your investment portfolio or guiding clients in their financial journey, always stay updated, stay diversified, and stay vigilant of the real-world risks of digital finance.

#FinancialPlanning #Investment #SingaporeFinance #MASRegulation #DigitalWealth #PortfolioManagement #InvestorEducation #OrionIncomePortfolio