CMFAS Difficulty Ranking: Which Exams to Take First?

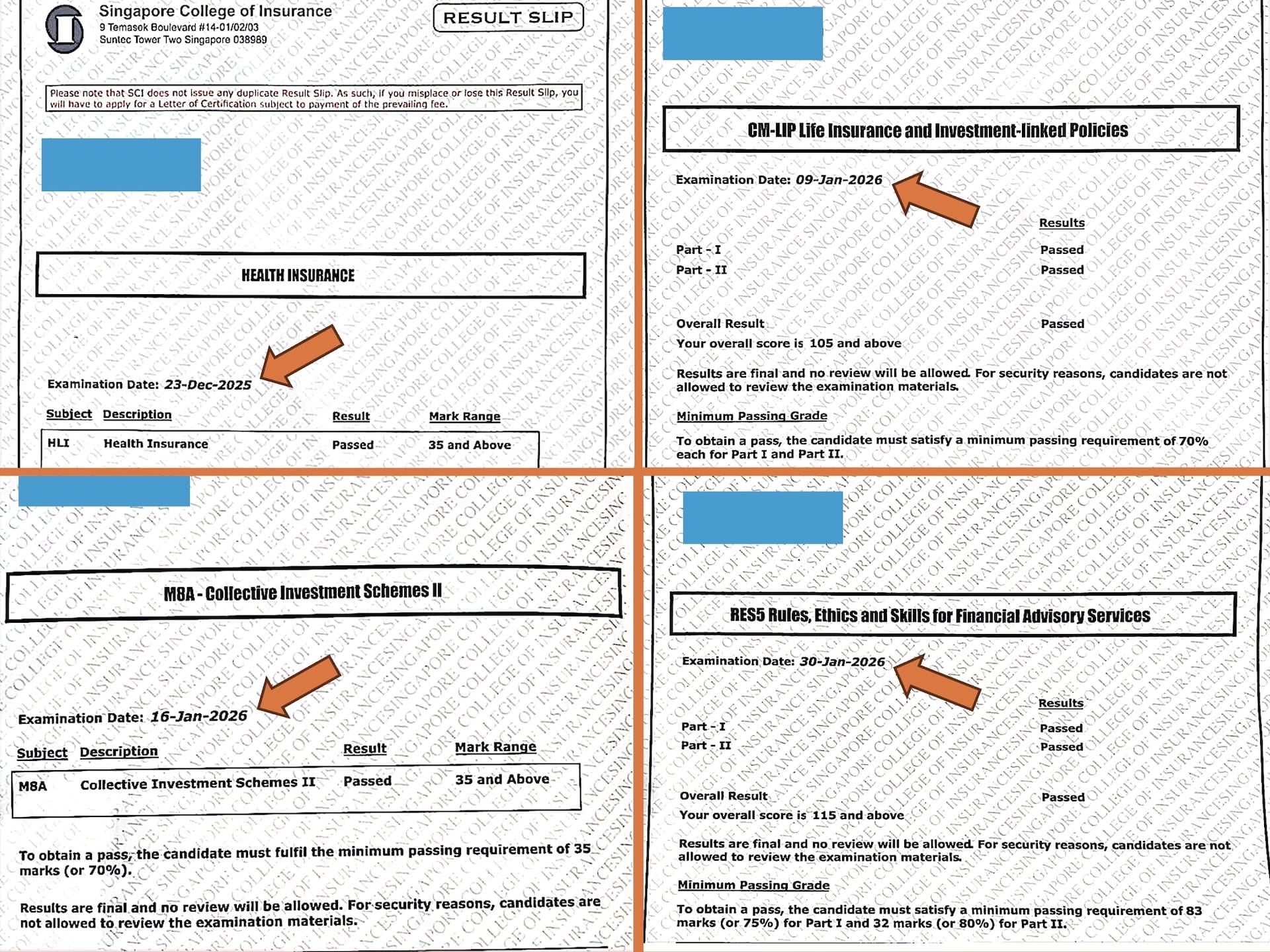

Whether you are switching careers or a fresh graduate, the CMFAS exams are your definitive gatekeeper towards a career in financial services in Singapore. The Singapore College of Insurance (SCI) has now fully transitioned to a more stringent "Two-Part" scoring system. This means failing just one segment, like the Ethics section in RES5, requires a full retake of the entire paper.

As someone researching career opportunities in our industry, you likely have questions like:

"Which CMFAS paper is the easiest to take first?"

"How much study time should I allocate per exam?"

"How many mock papers are enough to guarantee a pass?"

With fees for papers like RES5 and CM-LIC now ranging from S$218 to S$545 per attempt, these are expensive hurdles you want to clear on your first try.

Having mentored scores of professionals through this transition, I’ve seen that passing isn't just about studying harder; it’s about being exam smart. This guide provides a direct difficulty ranking and a strategic roadmap to ensure you clear your exams on the first try.

CMFAS Modules Requirements: At a Glance

Most insurance-tied agents in Singapore are only required to pass the foundational HI, RES5, and the CM-LIP (M9/M9A) suite. While this allows for insurance sales, it limits your ability to provide holistic financial advice.

At Orion Wealth Partners, we hold a higher standard. Every member of our team is required to clear M8 and M8A (Collective Investment Schemes) as a baseline. This ensures you are fully licensed to advise on Unit Trusts and managed funds, transforming you from a product seller into a true Wealth Manager. Furthermore, our senior partners go beyond the basics, holding the CM-EIP and CM-SIP (formerly M6/M6A) qualifications with The Institute of Banking & Finance (IBF) to provide guidance on complex instruments like ETFs and Derivatives.

| Module | Exam Fee | No. of MCQs | Duration | Passing Grade |

|---|---|---|---|---|

| HI | $76.30 | 50 | 1h 15m | 70% |

| M9 | $130.80 | 100 | 2h | 70% |

| M9A | $130.80 | 50 | 1h | 70% |

| CM-LIP(M9 + M9A) | $283.40 | 150 | 3h | 70% (Part I) & 70% (Part II) |

| RES5 | $218.00 | 150 | 3h | 75% (Part I) & 80% (Part II) |

| M8 | $130.80 | 50 | 1h | 70% |

| M8A | $130.80 | 50 | 1h | 70% |

| CM-CIS(M8 + M8A) | $283.40 | 100 | 2h | 70% (Part I) & 70% (Part II) |

| CM-LIC(M8 + M8A + M9 + M9A) | $545.00 | 200 | 4h | 70% for each Part |

| CM-EIP* | $250.70 | 90 | 2h 30m | 70% |

| CM-SIP* | $250.70 | 80 | 2h 30m | 70% |

| CM-CMP*(CM-EIP + CM-SIP) | $501.40 | 80 | 2h 30m | 70% |

You may qualify for MAS Module exemptions depending on your academic (e.g., Business, Finance, or Economics) or professional qualifications (e.g., ACCA, CFA). This could exempt you from modules like M8 or M9, significantly reducing your exam load and cost.

👉🏻 PM me to Check Your Exemptions

CMFAS Difficulty Ranking: From Easiest to Toughest

To pass on your first attempt, you need to sequence your papers strategically. Be wary of the "CM" (Combined Module) exams like CM-LIP or CM-CIS. While it may be tempting to "clear everything at once," these combined papers are often more costly and carry significantly higher risk.

If you fail just one segment of a combined paper, you fail the entire exam. This results in a higher re-exam fee compared to re-taking a single individual module. For most candidates, taking individual papers is the more strategic and cost-effective path to ensure a first-time pass.

| Module | Difficulty | Study Time | Remarks |

|---|---|---|---|

| HI / M8 | ⭐️⭐️ | 3 Days | Straightforward theory. High volume of definitions. |

| M9 | ⭐️⭐️⭐️ | 1 Week | Heavy on insurance concepts and theories. |

| M8A / M9A | ⭐️⭐️⭐️⭐️ | 1 Week | Both modules have similar study materials. Technical with more calculations. |

| RES5 | ⭐️⭐️⭐️⭐️ | 2 Weeks | Full on regulations and theories. Driest topic. |

| CM-EIP / CM-SIP | ⭐️⭐️⭐️⭐️⭐️ | 2 Weeks | Highly technical with calculations. |

The "Success Sequence" Exam Order

While you can technically sit for the papers in any order, there is a "Success Sequence" that my candidates follow to maintain a high first-pass rate. By starting with the foundational papers, you build the necessary momentum and technical vocabulary required for the more complex modules.

HI ➔ M8 ➔ M9 ➔ M9A ➔ M8A ➔ RES5

Why this works: We start with HI and M8 to get you familiar with SCI's questioning style and basic product rules. We then move into M9 and M9A while your "Life Insurance" knowledge is fresh. M8A is tackled next as its content is very similar to M9A. By the time you take your final paper, RES5, you will have the confidence and exam stamina needed to clear the strict 80% Ethics requirement on your first try.

CMFAS Exams FAQs

Q1. Which calculators are allowed in the exam hall?

A1. While the Casio FC-100V is the standard for wealth managers, any basic, non-programmable calculator on the SCI approved list is permitted. If you are taking calculation-heavy modules like M8A or M9, we recommend a financial calculator to handle Time Value of Money (TVM) functions. If you need to borrow one, PM me.

Q2. How realistic is it to self-study the materials in just 3 days or 1 week?

A2. The recommended study times in our table assume full-time study (6 - 8 hours a day). If you are currently a student or working a full-time job, you should at least double the estimated time. For a deeper dive into pacing your preparation, check out our article on How to Pass CMFAS Papers on Your First Try.

Q3. I don't understand how a mock paper arrived at an answer. Where can I find help?

A3. Be careful - we have seen mock papers in circulation that provide outdated or even incorrect answers. If you are stuck, do not memorize a potentially wrong answer. Seek clarification from your mentor or team leader immediately. If you need help, feel free to PM me on LinkedIn, and I’ll be happy to point you in the right direction.

Q4. What other ways can help further my understanding?

A4. While the SCI study materials are your primary source, searching online for specific concepts (like "Singapore Managed Healthcare") can provide much-needed context. However, be cautious with current LLMs (AI tools). They often struggle with the specific nuances of Singapore’s regulatory framework. Nothing beats a discussion with an experienced practitioner.

Q5. Are there ways to get cheaper exam fees?

A5. Yes. Booking your exams as an individual (non-member) is the most expensive route. If you book your exams through us, you can access Member Rates, which can offer over 15% savings compared to standard rates. If you are planning to take multiple papers, get in touch with me to find out how you can save on fees.

Beyond the Exams: Starting Your Financial Advisory Business Right

Passing your CMFAS exams is just the starting line. The real challenge is surviving your first two years. Many new consultants fail because they join the wrong environment. To succeed, you need to be on the right platform, follow a fair business model, and be supported by a team that prioritizes your growth over sales quotas.

Whether you are a fresh graduate or switching careers mid-stream, the team you join is the most important career decision you will make. If you want an honest conversation about how to choose the right platform and avoid the common pitfalls of this industry, let's talk. Connect with me on LinkedIn today to discuss your career roadmap and how we can help you start your journey on the right foot.