Trade Wars and Turmoil – Gold’s Role in Economic Uncertainty

Tariffs, taxes imposed on imported goods, have widespread economic effects, including inflation, market volatility, and currency fluctuations. These factors often indirectly influence gold prices, which tend to rise during inflationary periods or economic uncertainty as gold is a safe-haven asset.

How Modern Tariffs Are Fueling Economic Uncertainty

Recent U.S. tariff actions under President Trump have introduced significant upheavals to trade policies:

- Universal Tariffs: A baseline 10% tariff was imposed on all imports to the U.S., effective April 5, 2025.

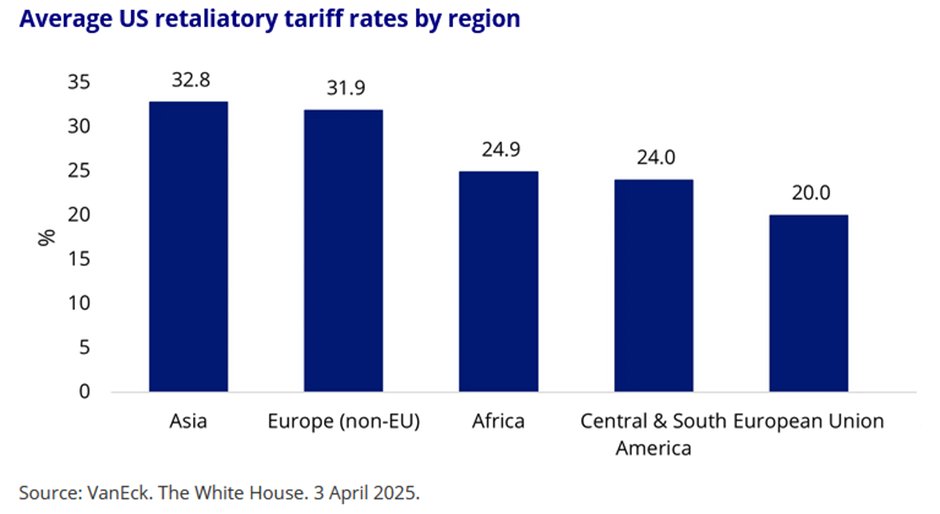

- Reciprocal Tariffs: Starting April 9, 2025, individualized tariffs were applied to 60 trading partners, with rates varying, supposedly based on trade deficits.

- China: Tariffs on Chinese goods were raised to 145%, targeting over $2.4 trillion worth of imports.

- European Union: Imports from the EU now face a 20% tariff rate.

- Asian Economies: Countries like Vietnam (46%), Thailand (36%), Taiwan (32%), and Japan (24%) are subject to increased tariffs.

These measures are claimed to address trade imbalances and protect domestic industries but have sparked concerns about inflation, supply chain disruptions, and global economic instability.

China, Europe, Asia: The Global Ripple Effects of U.S. Tariffs

In particular, China retaliated to the U.S. tariffs by dramatically increasing its own tariffs on American goods to 125%, imposing export controls on rare earth materials, and adding several U.S. companies to its "unreliable entity" list, subjecting them to punitive actions. Additionally, Chinese businesses began redirecting trade efforts toward Europe and the Middle East. These underscore the escalating global trade tensions.

While tariffs aim to protect domestic industries, they invariably lead to supply chain disruptions, higher consumer costs, and retaliatory measures. Gold prices typically respond to the economic and political consequences of tariffs, reflecting their role as a hedge against financial and geopolitical instability and inflation.

When Gold Prices React to Tariffs and Instability

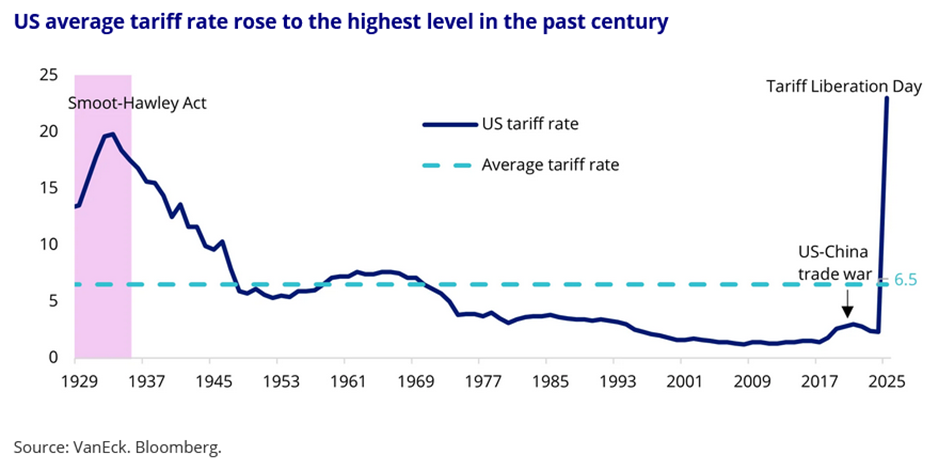

Let’s examine some historical instances where tariffs were dramatically raised and the effects they had:

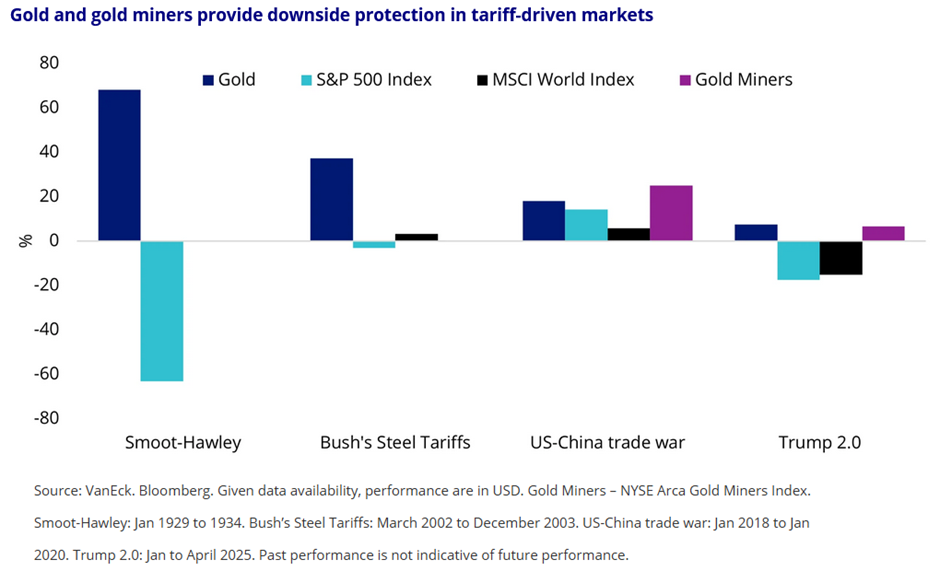

- Smoot-Hawley Tariff Act (1930): Introduced during the Great Depression, this raised import duties significantly but backfired by worsening the economic crisis with stifled trade and global retaliation. Gold prices remained stable as the U.S. was on the gold standard.

- UK Corn Laws (1815–1846): Heavy tariffs on imported grain protected British agriculture but raised food prices, causing financial distress. Eventually they were repealed due to widespread shortages and unrest. While it lasted, the tariffs created inflationary pressures, and during this period, gold demand increased as individuals sought a stable store of value amidst economic instability.

- France’s Tariff Policies (1870s–1910s): High tariffs on imports protected domestic industries but caused inflation and economic fluctuations. Gold demand increased as a hedge against these pressures.

- German Tariff of 1879: Imposed by Bismarck to boost domestic production, it led to inflationary pressures and higher costs for essential goods, but it contributed to Germany's industrial strength and growth. Gold demand rose as a hedge against inflation and economic policy risks, reinforcing its role as a safe-haven asset.

- Nixon’s Import Surcharge (1971): A temporary 10% tariff on imports coupled with the end of the gold standard led to inflation and a dramatic rise in gold prices.

- Steel and Aluminum Tariffs (2002 – Bush Administration): Aimed to protect U.S. producers but increased manufacturing costs. Gold prices rose, influenced by a weakening U.S. dollar and broader economic trends.

- U.S.-China Trade War (2018–2019 – Trump Administration): Tariffs on hundreds of billions in goods caused higher consumer prices and market volatility. Gold prices surged as investors sought stability amid economic uncertainty.

- Post-Pandemic Tariffs (2021–2023): Continuing trade restrictions combined with global supply chain disruptions fueled inflation. Gold peaked at $2,050 per ounce in 2022 due to rising uncertainty and inflationary pressures.

How to Build Stability in a Shaky World: Gold and Beyond

Gold, while a safe-haven asset, has some drawbacks. Its prices can be very volatile, responding to market and geopolitical shifts. Opportunity costs may arise as funds invested in gold might yield higher returns in other assets. It also does not generate income like equities or bonds. While investments in gold mining companies can offer leverage to gold prices and income, they are inherently more complex and unpredictable compared to holding physical gold. Furthermore, gold and gold mining equities have already experienced a significant surge in recent months, potentially limiting future upside and increasing the risks of a correction.

Gold has historically been a reliable hedge against inflation, currency devaluation, and financial instability, maintaining its value through economic downturns. Investors gravitate toward gold during periods of inflation, geopolitical uncertainty, or low interest rates, as it helps preserve purchasing power and stabilize investment portfolios — particularly in times of tariff-induced economic shifts.

Build Resilience Into Your Portfolio — Even in a Trade War

Gold may shine during economic chaos, but true portfolio stability comes from smart diversification. An income payout portfolio built to weather market volatility and generate steady returns will help you sleep better at night.

Navigate uncertain times with confidence through our Income Portfolios, designed to provide regular income payouts and financial stability. Whether you're safeguarding against inflation, tariffs, or currency fluctuations, our strategic approach ensures your money keeps working for you — even when the headlines signal turmoil in the world.