How We Consistently Grow Productive Investment Consultants

Are you an aspiring financial professional or a seasoned advisor looking to consistently grow as an investment consultant? Many seek to build a scalable and profitable investment advisory business, yet struggle to find the right support in an industry often focused on traditional insurance and commission-based sales.

Since Orion Wealth Partners' formation in 2014, we've not only prioritized solid independent investment advice for our clients, built our Assets Under Advisory (AUA) to over $75 million, but more importantly, we've cultivated an environment where consultants thrive.

What truly sets us apart is our proven track record in empowering consultants with a genuine passion for investment to build thriving, sustainable practices. Almost 40% of our consultants achieve their first $10 million AUA within just 5 years of joining, and remarkably, all of them were mid-career transitioners from diverse non-financial backgrounds.

In the space of investment advisory, our consultants consistently rank among top producers on leading investment platforms like Singlife’s GROW, iFast, FWD, and finexis Asset Management (FAM).

So, what’s the “secret” behind our investment success in an industry dominated by commission-based insurance sales?

Specialized Financial Consultant Training: Our Investment-Focused Breakfast Club™

The journey to becoming a highly productive investment consultant at Orion Wealth Partners begins with a proven foundation: Breakfast Club™. This signature 'first 90-days' rookie training program, a cornerstone of finexis advisory for over two decades, boasts a track record of producing hundreds of successful MDRTs, COTs, and TOTs.

We infuse Breakfast Club™ with a specialized 'investment flavour' exclusive to Orion Wealth Partners. Unlike many other agencies that focus broadly, our consultants take up additional, specialized investment-related CMFAS papers. Everyone in the team must be equipped to offer investment advice from day one.

This robust onboarding ensures that whether you're a mid-career transitioner or an existing practitioner seeking to deepen your expertise, you're provided with professional tools and knowledge to kickstart your investment advisory practice.

Fun Fact: Two of Orion's own leaders are part of the core training team, actively teaching and sharing the Breakfast Club™ methodology with financial consultants in Malaysia and Taiwan.

Building a Scalable and Productive Investment Advisory Business: Our Tech & Process Edge

Central to how we consistently grow productive investment consultants at Orion Wealth Partners is our strategic investments in professional financial modelling software and processes. They are the critical enablers for building a truly scalable and profitable investment advisory business for our consultants.

From the earliest days, where we embraced US-based Torrid Retirement Planner, to pioneering the use of GoalsMapper Pte Ltd, and leveraging finexis advisory’s Merlin, our focus has always been to empower clients through interactive, visualization charts. This "advise-not-sell" approach ensures clients take ownership and positive action. In recent years, our investment in advanced platforms like FE Analytics for in-depth fund research, comprehensive analysis, expert portfolio construction, and ongoing monitoring of offerings like our Orion Income Portfolios equips our team with unparalleled capabilities.

This robust tech stack forms a core pillar of our investment advisor development and capability. Junior consultants undergo comprehensive financial consultant training to master our proprietary fact-find (FF), financial needs analysis (FNA), and review process. Our systematic workflow allows us to scale your operations and ensure consistent servicing of your clients. Handling 100 or 200 investment clients efficiently? No sweat with our dedicated ‘Done-For-You’ support and rebalancing.

This invaluable support frees up our consultants to focus on high-value activities: deepening client relationships, acquiring new clients, and ultimately accelerating their own investment consultant career growth by fostering a truly productive and sustainable investment practice.

Our Collaborative Advantage Accelerates Our Investment Consultants' Growth

The financial advisory industry is known to be very solo in consultant’s practice, but not in Orion Wealth Partners. We firmly believe that building a profitable investment advisory practice cannot be a solitary journey. Instead, we cultivate a vibrant ecosystem of cooperation and shared knowledge.

At the heart of our collaborative approach are our specialized internal groups. Our Investment Fellows, comprised of seasoned investment leaders, convene monthly. These sessions are crucial for discussing nuanced market outlooks, tackling complex portfolio construction issues, and exploring alternative investment strategies.

For those embarking on their journey, especially mid-career transition financial advisors, Orion Income Club offers practical on-the-job training. Meeting fortnightly, our junior consultants actively learn, share best practices, and collaborate on diverse projects. This continuous team cooperation is paramount not just for building confidence in our 'juniors' but for elevating the overall competency of our entire team.

We actively collaborate with external stakeholders too! Seeking out like-minded investment advisors and industry experts to foster mutual growth and learn from diverse perspectives. Our investment head maintains regular engagement with finexis Asset Management, gaining unique insights into their asset allocation strategies and market outlooks.

Furthermore, for the core funds within our Orion Income Portfolios, our Investment Fellows attend in-depth fund briefings and meet with Fund Managers. These unparalleled access allow us a deep dive into fund selection criteria, analysis, strategic direction, and operational processes of external partners.

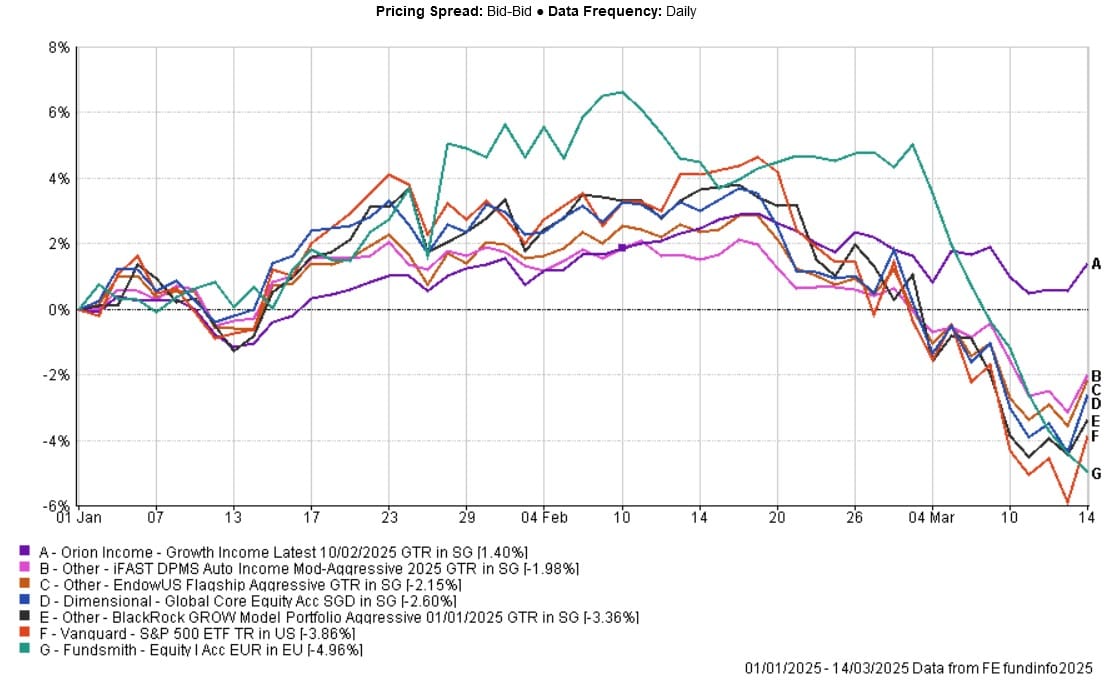

Our culture of perpetual learning and shared expertise is a cornerstone of our investment advisory practice. Despite consistently achieving above-average portfolio performance (as evidenced by our comparison chart below), we recognize that the way to sustain growth and achieve a truly scalable investment advisory business is by continuously learning from credible sources and empowering our consultants with this collective wisdom.

Our Consultants Become Productive Investment Advisors By Walking The Talk

At Orion Wealth Partners, our commitment to sound independent financial advice isn't just a philosophy, it is a practice we live by. We firmly believe that nothing speaks louder than action, which is why our consultants are the biggest investors in the very portfolios we recommend, often followed closely by our loved ones.

Long-term investment success hinges not just on superior asset allocation, but equally on the investor's emotional discipline. It's during challenging bear markets, when fear and anxiety can prompt even seasoned clients (and sometimes less confident advisors) to prematurely pull out of their investments, that an advisor's profound professional conviction becomes paramount. The tougher the market conditions, the more we need to guide our clients.

For mid-career transitioners or existing practitioners seeking to elevate your advisory business, this ingrained practice is a powerful differentiator. It builds intrinsic confidence, enhances credibility, and ultimately leads to stronger, more resilient client relationships. This deep-seated conviction is a critical component of our investment consultant career growth framework, ensuring the long-term profitability and sustainability of our advisory practices.

Ready to accelerate your investment consultant career growth with a team that truly walks the talk? Discover how you can become grow your investment advisory business with Orion Wealth Partners. Reach out to us today to explore this unique opportunity.