Orion Income Portfolios – Market Update (Apr 2025)

Since Trump’s tariff announcement, there has understandably been a wave of panic selling among investors. This sell-off has been further exacerbated by the unwinding of leveraged positions, amplifying market volatility.

It’s worth noting, however, that while some investors react in panic, others view this as an opportunity they’ve been waiting years for — buying into the markets at significantly lower prices. Historically, times like these tend to divide investors into two distinct groups: those who panic and sell at a loss, hoping to re-enter when markets recover, and those who remain patient, using the turmoil to buy assets at attractive valuations. Those who actualize losses often find themselves stuck in a recurring cycle of “selling low and buying high”, while the patient and informed investors benefit from the reallocation of capital.

Should We Switch Out of Equities to Bonds or Cash?

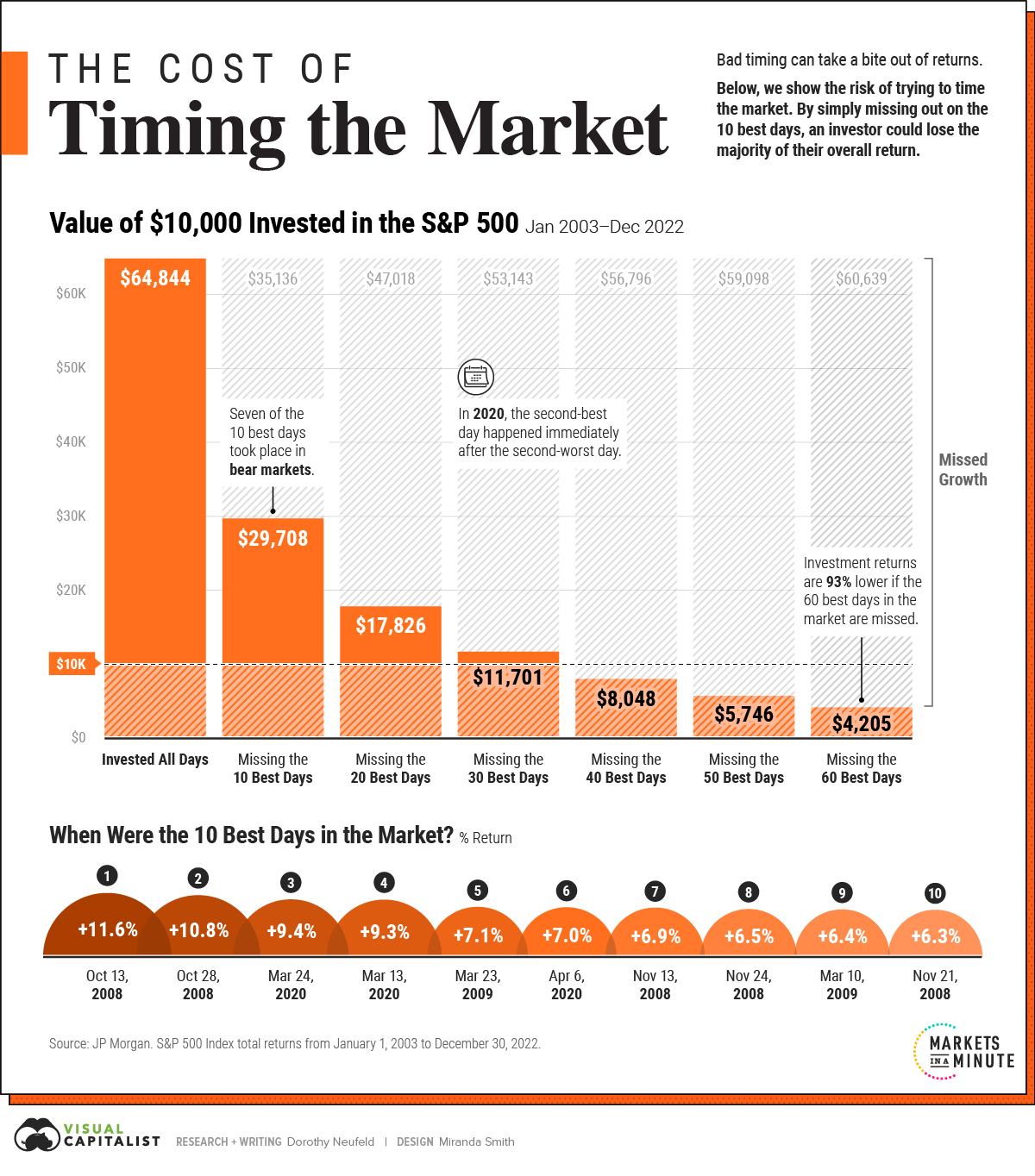

Questions about switching equity exposure to lower-risk bonds or cash portfolios are understandable during uncertain times. Yet, we strongly caution against completely exiting equities. History has shown that investors who leave the markets during downturns often miss the recovery surge, hindered by the psychological barrier of re-entering equities again. Fear, uncertainty, and doubt make it challenging to re-enter until momentum builds — by which time, prices will be significantly higher.

Equity markets are unpredictable, and recoveries can occur suddenly and swiftly, often driven by unexpected good news. For example, in August 2024, a surprise interest rate hike by the Bank Of Japan strengthened the Yen, triggering an unwinding of Yen carry trade positions and sharp market corrections. There were investors who panicked and sold off their holdings, unaware of the temporal cause of the decline. Once markets realized that the sell-off was unwarranted, a sharp recovery followed, catching many by surprise.

More recently, on 7 April 2025, rumours of Trump pausing tariffs spurred a swift surge in the S&P500. When the rumour was debunked, the index dipped again. These events suggest that markets are poised to surge on positive developments — even a mere rumour about a tariff pause was able to spark rapid gains.

This demonstrates two key points:

- The current tariff crisis is caused by a man's decision and can be moderated at any time.

- Trying to time the markets and selling equities now risks missing out on a strong recovery surge when sentiment shifts positively.

7 of the 10 best days in the past two decades happened in bear markets, which may be similar to the one we have just witnessed on 9 Apr 2025 when it was reported that "S&P 500 had its best day since 2008 and the Nasdaq its biggest gain since 2001".

How Our Income Portfolios Derive Value For Investors

In investing, patience and temperament often outweigh intellect. While the current volatility may feel unsettling, we have spent the last two years focused on improving portfolio quality, reducing volatility, and enhancing resilience. Despite the crises and conflicts of 2023, 2024, and the ongoing trade wars of 2025, our Portfolios, though not immune to market sentiments, have demonstrated resilience and stability.

Since 20 January 2025, the day of Donald Trump’s inauguration as the 47th U.S. President, our Portfolios have seen relatively modest corrections:

- Conservative Secure Income Portfolio: -2.8%

- Balanced CPFOA Portfolio: -3.4%

- Balanced High Payout Income Portfolio: -5.7%

- Aggressive Growth Income Portfolio: -7.7%

- Ultra-Conservative Cash Portfolio: +0.74%

The ultra-conservative Cash Portfolio, also favoured by corporations, is on track to complete the year well above CPF-OA and Fixed Deposit rates.

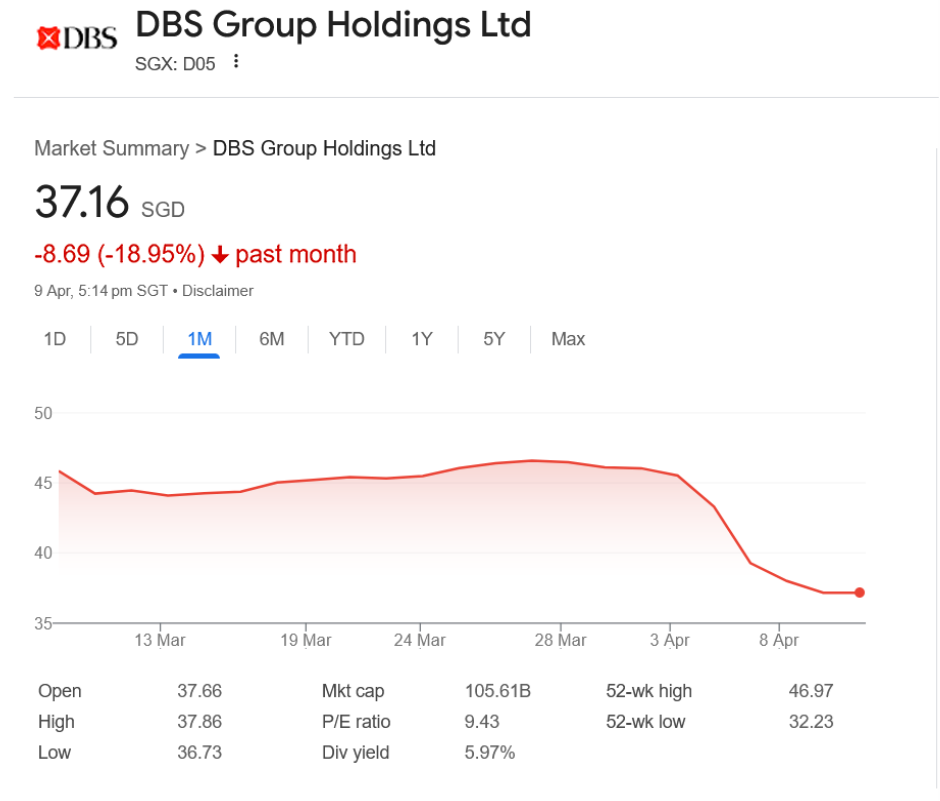

Compared with Other Investments

Compared to the S&P500, and prominent bellwether stocks in Singapore, such as DBS, which have declined over -16%, as well as funds that were overly weighted in US and tech equities, our diversified Portfolios have performed resiliently. Furthermore, the income generated by our Income Portfolios, comparable to property rentals, is available for reinvestment, further strengthening their positioning for recovery.

As the saying attributed to Sun Tze goes, “If you wait by the river long enough, the bodies of your enemies will float by.” This illustrates the timeless virtue of patience and the inevitability of outcomes with time. For investors who are neither heavily invested in risky assets nor in urgent need of liquidity, there is little to fear. Allow time and circumstances to do their work. And the stability and strategy of thoughtful investing will guide you.