Orion Income Portfolios – Investment Brief (Feb 2025)

Key Points

Tariffs as Leverage

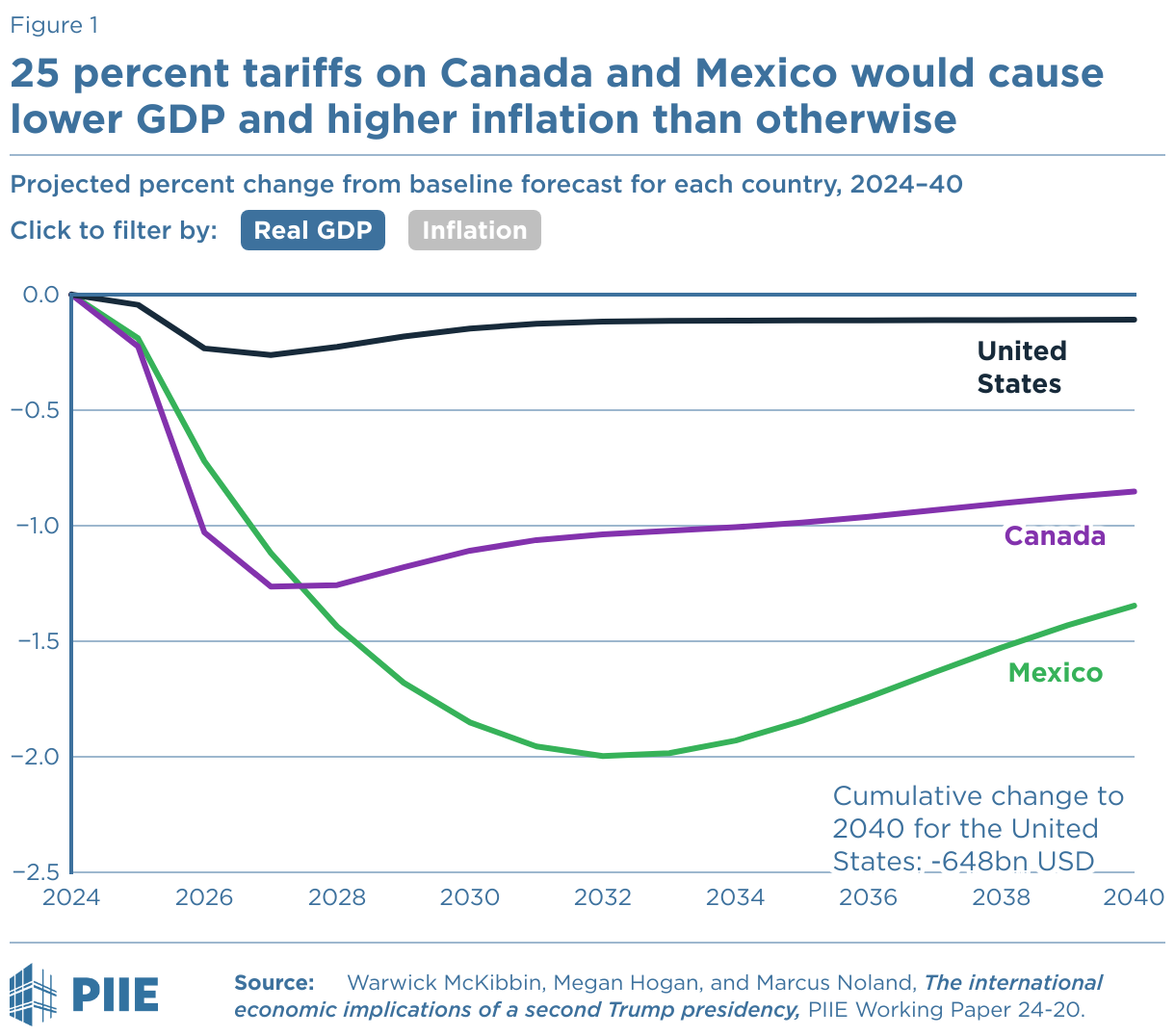

The return of a familiar playbook—using tariffs and aid as leverage in high-stakes negotiations. With the US in a stronger economic position, tariffs and aid can be effective bargaining tools.

Volatility Under Trump

Financial markets can continue to climb if tariffs remain measured and global growth stays resilient. Markets are more prone to quick reversals with every news headline, making it more important than ever not to invest emotionally.

Impact on Sectors and Investments

Equity Sectors: Rising costs and disrupted supply chains from tariffs create uncertainty in several sectors, particularly those that are heavily reliant on international trade and complex supply chains.

Credit Risk: Shifting trade dynamics increase credit risk and potential bond downgrades, making it crucial for fixed-income investors to carefully navigate changing fundamentals.

Inflation and Interest Rates: Tariffs may fuel inflation, forcing central banks to maintain or even raise rates, which would negatively impact long-duration bond prices like Treasuries.

Investment Opportunities

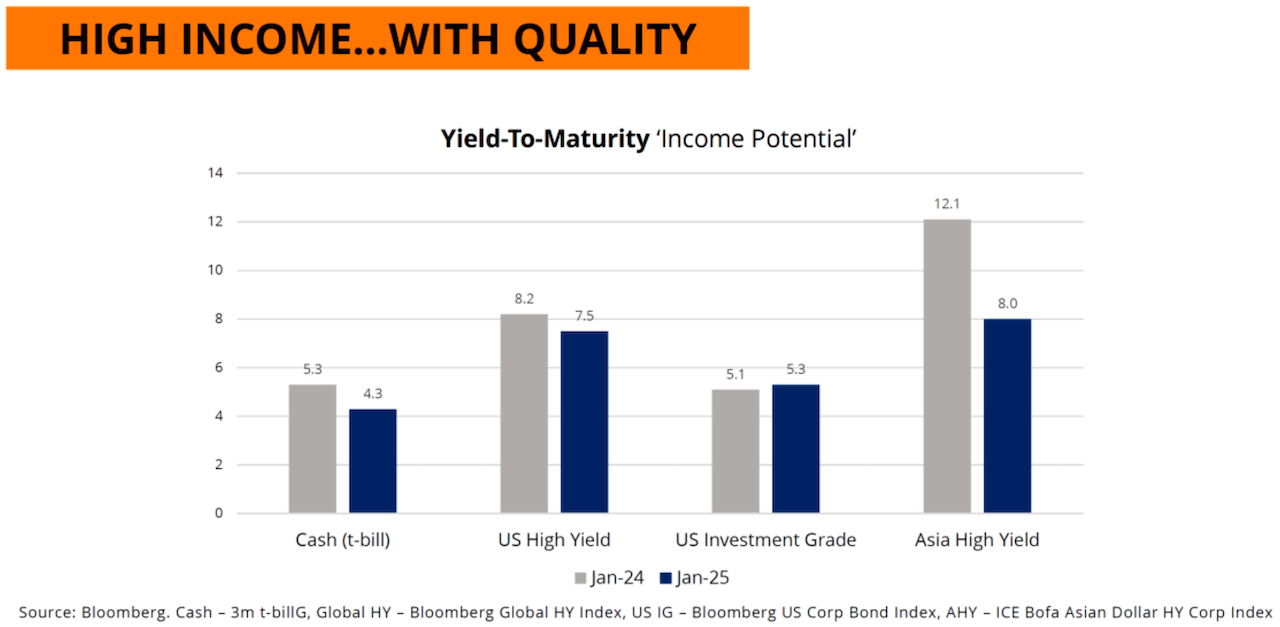

High Yield Fixed Income

Despite the risks, attractive opportunities are still found within High Yield fixed income. Tilting towards short-duration assets can help mitigate rate risks while focusing on good income options.

Equity Investment Strategy

For equities, we prioritize funds that invest in profitable companies with lower volatility compared to their peers. Our strategy has proven both unique and profitable in recent years. We expect it to perform on par with, or even outperform, high-growth approaches in the long term, especially against a backdrop of increased economic uncertainty and market volatility.

Orion Income Portfolio Adjustments

Growth Income - Cash/ SRS

Switch 100% of Principal ASEAN Fund to Fidelity ASEAN Fund – The Fidelity ASEAN Fund provides continued targeted exposure to the ASEAN region with attractive long-term growth prospects. At this time, the Fidelity ASEAN Fund has a higher net margin ratio (27.3%) and return on assets (7.6%), making it more attractively valued compared to the Principal ASEAN Dynamic Fund.

Sustainable CPF-OA

Switch Schroder Global Emerging Market Opp to Schroder Asia Equity Yield Fund – The Global Emerging Market Opportunities Fund has a broader geographic focus on emerging markets worldwide, while the Asian Equity Yield Fund targets the Asia Pacific (ex-Japan) region, known for its high dividend yields.

Schroder Asian Equity Yield Fund especially focuses on quality companies with steady dividend streams. The region's rapid economic growth, driven by urbanization, a growing middle class, and ongoing infrastructure investments, is expected to boost equity returns and dividend growth.

All Other Cash / SRS Portfolios

Switch 50% of Franklin Floating Rate Fund to Allianz US Short Duration High Income Fund – The Franklin Floating Rate Fund focuses on high current income and preservation of capital. However, as global interest rates ease in the near term, its yields are expected to decrease. On the other hand, US High Yield Bonds are more volatile but are now projected to provide attractive risk-adjusted returns.