Orion Income Portfolios – Market Update (Aug 2025)

🗒️ 2025 has definitely kept investors on their toes. Between shifting trade dynamics, geopolitical surprises, and the relentless march of AI-driven innovation, markets have had plenty to react to. July brought a wave of optimism, but under the surface, there are still signs of caution. Our focus remains focused on staying grounded - leaning into quality, income, and smart risk management while keeping an eye on what’s next.

Market Performance & Portfolio Strategy

📜 Bond Strategy

- Global bonds fell in July, with the Bloomberg Global Aggregate Index down 1.49%, driven by a stronger USD.

- Portfolios positioned for USD weakness under-performed, while those focused on natural income, like Orion Income Portfolios, continued to deliver gains.

- Strategy remains overweight in high-quality, high-income, short-duration bonds, allowing investors to capture elevated yields with reduced volatility.

📊 Market Sentiment & Outlook

- Geopolitical risks have eased slightly, with Middle East tensions abating.

- Tariff concerns persist, notably with Trump’s renewed focus on India’s trade barriers and Russian oil imports.

- Q2 corporate earnings were solid, but signs of a slowing economy suggest potential headwinds in the second half.

- July optimism was fuelled by strong US data and favourable trade deals with Japan, the EU, and South Korea.

- Sticky inflation may push bond yields higher, creating pressure on equities and other risk assets.

- Safe-haven assets like gold and Treasuries weakened amid rising US yields and shifting investor sentiment.

- Despite inflation concerns, bond markets are strongly pricing in a U.S. Fed rate cut in September 2025, reflecting expectations of a pivot toward monetary easing.

- Market sentiment has shifted from Fear (April) to Greed (July) - the market is navigating a complex balance between persistent inflation and anticipated policy accommodation, leading to heightened volatility across asset classes.

📈 Equity Strategy

- The AI + Tech theme continues to drive markets, but risk/reward dynamics have become less favourable, suggesting a possible short-term consolidation.

- Strategy remains focused on larger cap, value-oriented companies with strong balance sheets and cash flow, well-positioned to benefit from a rotation toward safer assets.

Orion Income Portfolios Performance Update

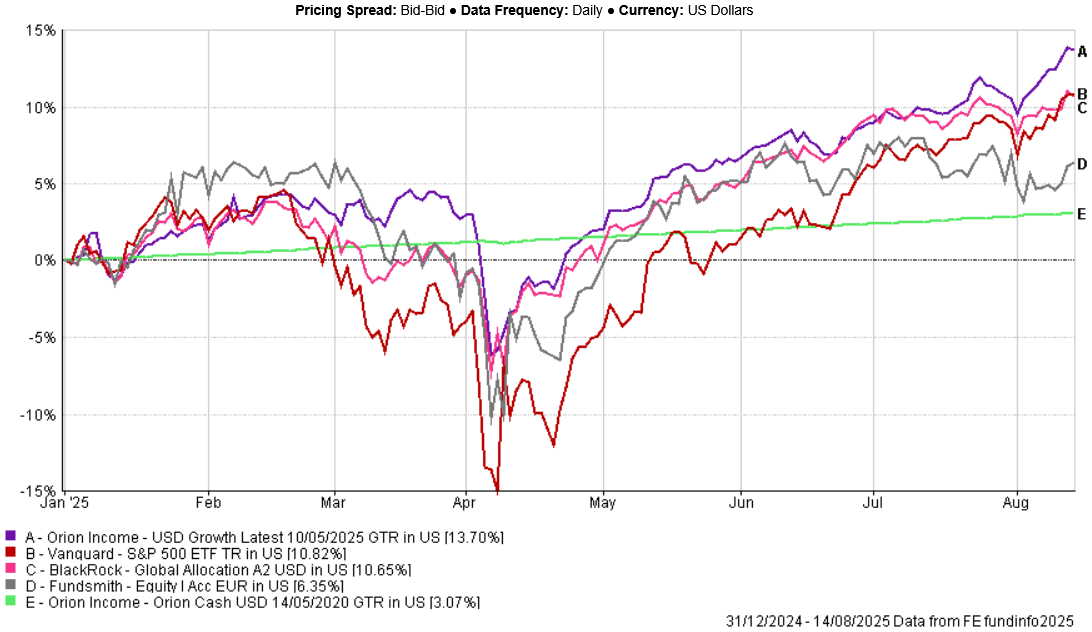

Let's take stock of the year-to-date performance starting with our Growth-Oriented Portfolio.

- By selecting fund managers with a strong track record in larger cap, value-oriented strategies, emphasizing defensiveness and a quality bias, we have built a more resilient Portfolio that consistently delivers lower volatility and reduced drawdowns. Our Portfolio has outperformed BlackRock Global Allocation Fund, Fundsmith Equity Fund (EUR), and many other comparable funds.

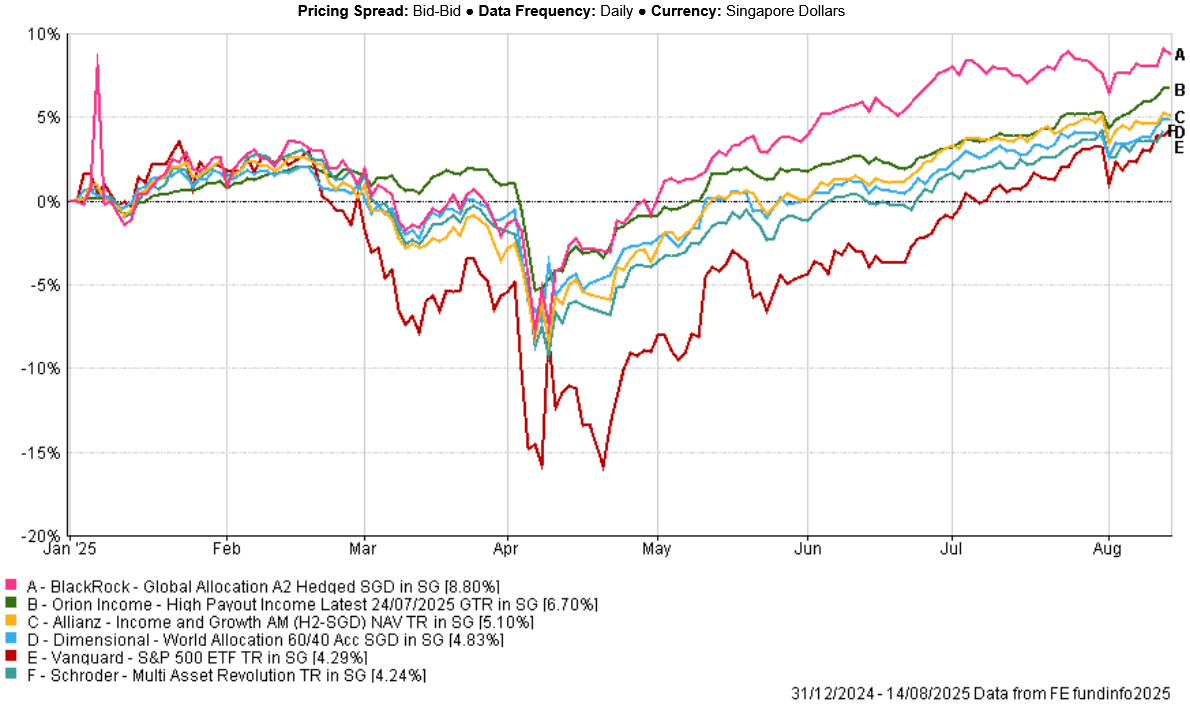

Next, we look at the year-to-date performance of our High Payout Income Portfolio.

- US President Trump's April 2nd announcement of sweeping new tariffs (aka "Liberation Day", sparked a sharp market selloff. The measures included a 10% baseline tariff on nearly all imports, with significantly higher rates imposed on key trading partners, reigniting concerns of a global trade war. Amid this volatility, the High Payout Income fund demonstrated relative resilience, experiencing only a mild correction compared to its peers and rebounding soon after. This stood in contrast to the broader market, where the S&P 500 index declined by over 10%, alongside steep losses in many US-centric funds.

- Overall, the High Payout Income Portfolio managed a YTD return of 6.70% even with lower volatility compared to peer funds from BlackRock, Allianz, Dimensional and Schroders.

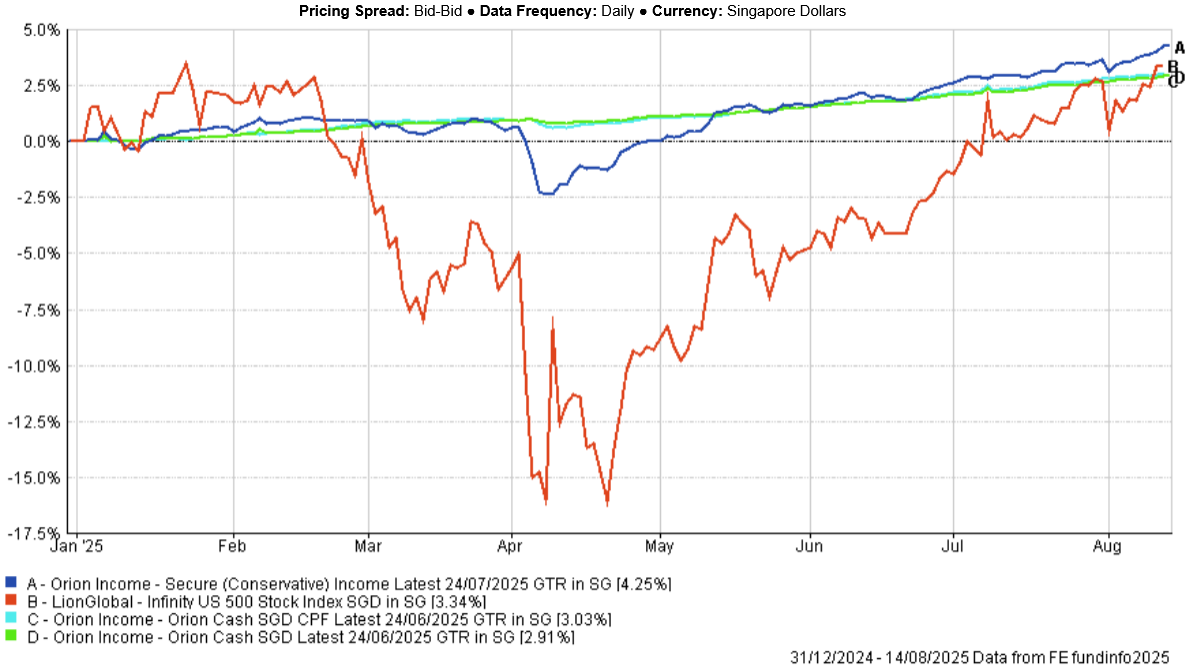

Finally, we look at the year-to-date performance of our Conservative Secure Income Portfolio and the Ultra-conservative Cash and CPF Portfolios.

- The charts highlight that both our Conservative and Ultra-Conservative Portfolios exhibited very low volatility, serving as a stabilizing anchor amid market turbulence. Notably, the Ultra-Conservative investments remained largely unaffected by recent market events and are on track to surpass our target return of 4% by year-end.

Do reach out to your Financial Consultant with you have any questions about your investments in Orion Income Portfolios.