Beyond Fixed Deposits: Smarter Reserves Management for Charities in Singapore

Many local charities in Singapore tend to place their reserves in fixed deposits for safety, but these may not be sufficient to meet long-term needs. As these local charities grow, their reserve strategies should evolve too.

The good news is there are smarter reserve management strategies that provide better yields without sacrificing stability or liquidity. These strategies work for both small and large charities while fully complying with regulatory and governance requirements.

In this article, you’ll discover our smarter, compliant approaches to reserves and investment management, inspired by best practices from The Handbook on Charities’ Reserves and Investments (Handbook 4) supported by the Charity Council, along with real-world examples.

The Risks of Relying Only on Fixed Deposits (FDs) for Charities’ Reserves

Most charities adopt a conservative approach towards investment and place their funds in safe, low risk options. Apart from being prudent in financial management, charities should actively use their reserves as part of a finance strategy to develop greater sustainability, by diversifying their income streams. Investments could generate an additional source of income and help charities build up and better manage their reserves (Sim, Loh & Teo, 2017).

While FDs are a common choice for local charities in Singapore due to their safety and simplicity, relying solely on them may not be the most effective way to manage reserves.

Erosion of Value from Inflation

With FD rates averaging below 2% p.a. recently and expected to drop further by 2025, they are becoming less viable, especially when compared to Singapore’s inflation rate of around 3%. This leads to negative real returns and a gradual erosion of purchasing power over time.

Lack of Diversification

Concentrating reserves in a single instrument like FDs exposes organizations to reinvestment risk when rates shift. It also limits the ability to balance liquidity needs with growth potential. An adequately diversified portfolio can provide greater resilience and better long-term outcomes.

Opportunity Cost

A one-size-fits-all fixed deposit strategy ignores other stable, high-quality instruments available. Low-risk alternatives such as government bonds, high-quality short-term instruments, or managed funds aligned with the organization’s risk appetite can help reserves deliver positive real returns while maintaining safety or liquidity. [Tip: Handbook 4 advises boards to explore a wider range of options beyond FDs, which will be discussed later.]

By proactively reviewing reserve strategies and balancing security with value preservation, local Charities can better safeguard their reserves for future programmes and the ability to fulfil their mission's sustainability.

📌 The Case for Diversifying Charity Reserve Portfolios

Why Diversification Matters for Non-profits Including Charities

The adage “don’t put all your eggs in one basket” applies to how Charities manage reserves. Relying solely on one instrument like FD can seem safe but exposes Charities to inflation risks and missed opportunities for better returns. Different financial instruments respond to changing economic conditions, so diversifying can help build a more resilient reserve strategy.

Diversified Instruments Charities Can Use

Charities of all sizes are exploring a variety of instruments, such as:

- Short-duration bonds: Stable returns, less impacted by interest rate changes.

- Money market funds: Low-risk, highly liquid, ideal for short-term needs.

- Endowment funds: Long-term growth and income generation for strategic reserves.

- Tiered portfolios: Low-risk instruments for operational reserves, higher-return assets for long-term goals.

Aligning Investments with Needs and Risk Appetite

Charities typically hold different types of reserves, each with distinct liquidity and risk profiles:

- Operational reserves: For short-term needs.

- Contingency reserves: For unexpected events.

- Strategic reserves: For future growth or sustainability.

Matching these reserves to suitable financial instruments—based on their time horizon, liquidity, and risk tolerance—is key to effective reserve management. This is the essence of the tiered reserves strategy outlined in Handbook 4, which ensures that each reserve type is appropriately aligned with its purpose.

A well-diversified strategy helps balance the critical elements: Safety, Liquidity, and Returns. While FDs are safe, they offer low returns and limited flexibility. By spreading reserves across varied instruments with different risk-return profiles, Charities can:

- Preserve capital for short-term needs.

- Maintain liquidity to meet obligations.

- Generate higher returns on long-term reserves, supporting mission sustainability.

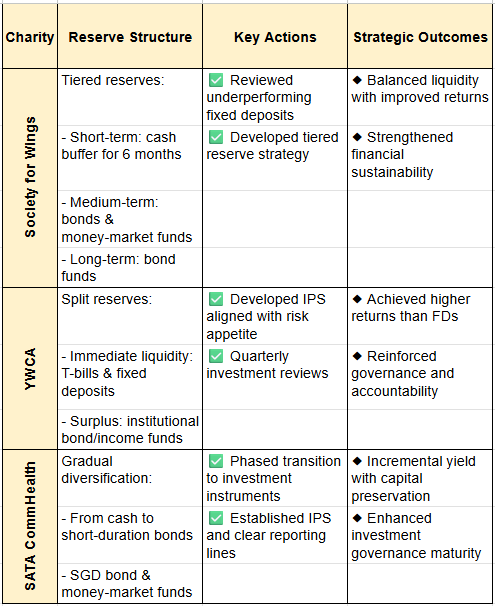

Real-World Examples of Diversification in Practice

SATA CommHealth (SATA) shifted part of its reserves from fixed deposits into a mix of bonds, equities, and money market instruments. Their investment strategy focuses on broad diversification to balance capital preservation with long-term growth. The results were clear: From 2006 to 2017, SATA’s portfolio earned an average return of 5% per annum, totaling $34 million—far exceeding the $4 million returns had the funds been placed in FDs.

Similarly, Society for Wings adopted a tiered reserve strategy, allocating operational funds to low-risk deposits while placing strategic reserves in longer-term investments. Their approach was driven by a desire to balance liquidity with better returns, especially after reviewing their underperforming FDs.

Key Takeaways:

- Strategic Intent: Their charities’ reserve structures are designed to balance liquidity, return, and risk.

- Governance: Their investment policies and oversight mechanisms are tailored to each charity's needs.

- Capacity Building: SATA’s shift wasn’t just financial; it also involved internal system improvements.

These examples, shared in Handbook 4, illustrate how a diversified reserve policy doesn’t mean taking big risks. It means being deliberate, structured, and forward-thinking.

Addressing Investment Concerns

Many charity boards are wary of investing beyond FDs due to worries about capital loss, reputational risks, or limited investment knowledge. While these concerns are valid, they are also manageable. By implementing clear investment policies, strong governance frameworks, and seeking professional advice, these risks can be effectively mitigated. Regulatory guidance, like Handbook 4, offers a useful roadmap to help charities develop responsible reserve strategies that align with their missions.

The aim isn’t to take unnecessary risks but to avoid a greater one—letting reserves sit idle in FDs and lose value over time.

How Orion Income Portfolios Can Help Charities

In uncertain markets, your mission deserves stability. A diversified approach reduces risk and helps grow your reserves over time.

A Smarter, More Stable Strategy from Orion Wealth Partners

We, a group of investment professionals, at Orion Wealth Partners developed a portfolio approach that departs from the typical “growth-focused” portfolios. With over 30 years of combined experience, our portfolios are designed to deliver half the volatility of traditional options. We select funds that invest in profitable companies with natural income payouts, a crucial feature for Charities needing capital preservation and stable income.

Alternatives to Endowus, Dimensional, and Blackrock

After observing the market correction of 2022, we observed that Charities and long-term investors needed something different. Launched in late 2023, Orion Income Portfolios provide fresh alternatives to popular portfolios like Endowus, Dimensional, and Blackrock.

Our portfolios are rigorously tested for performance resilience and have outperformed others since 2024. In 2025, our lower-volatility strategy has demonstrated stability amid global uncertainties.

Backed by finexis advisory, Now Part of KKR

Our solutions are now even more compelling with the latest development: finexis will be acquired by KKR, a leading global investment firm. This partnership boosts our research, expands institutional resources, and strengthens our commitment to long-term stewardship. For Charities, this means access to institutional-grade strategies delivered through a trusted local platform.

Meet Reserve Management Requirements

- Custom Portfolios Within IPS Guidelines: Diversified instruments like short-duration bonds, high-quality income-generating assets

- Professional Management: Active reviews, transparent reporting, and alignment with regulatory expectations.

Summary of Smarter Strategies (TLDR)

✔️ Tiered Liquidity Design: Our portfolios can incorporate a mix of instruments with different maturities so you can access funds when you need them.

✔️ Professional Yield-Enhancement: Designed to generate stable returns above FDs, protecting purchasing power.

✔️ Full Compliance & Governance: Our portfolios fit seamlessly into your Charities-approved IPS, with robust oversight tools.

✔️ Low-Cost, Diversified Approach: Broadly diversified funds reduce risk and keep fees low, so more capital works for your cause.

Let’s Help Your Charity Move Forward Safely and Sustainably

Whether you're reviewing your current reserve policy or looking for professional investment advice, Orion Wealth Partners and finexis advisory stand ready to partner with you. With institutional insight and local understanding, we’re committed to helping your organization secure its financial foundation so that you can focus on what truly matters - Your Mission.

👉 Contact us today for a no-obligation consultation to put your reserves to work towards your Charity's mission!